BioByte 102: AI reasoning models for science, pharma deals for TechBio, R-loops in psychiatric indications, & the launch of a long-awaited non-opioid painkiller

Welcome to Decoding Bio’s BioByte: each week our writing collective highlight notable news—from the latest scientific papers to the latest funding rounds—and everything in between. All in one place.

After a January hiatus, we’re back with our weekly BioByte!

What we read

Blogs

AI for science with reasoning models [Andrew White et al., Diffuse One, Jan 2025]

Andrew White, Co-Founder at FutureHouse, discusses the impact of reasoning models across scientific research (the Decoding bio team wrote about FutureHouse here).

Recent models have exceeded human performance on complex reasoning tasks through the use of extended Chain of Thought (CoT) reasoning during inference and balancing training and inference-time compute. In fact, when models are trained on successful reasoning trajectories and using reinforcement learning on specialized tasks, small models can beat larger ones, as shown in DeepSeek’s R1 paper where its 14B model beat OpenAI’s o1-mini across multiple benchmarks.

What are the consequences for the use of AI in Science? He mentions how the notion that “language models can only interpolate plans/reasoning patterns seen in pre-training” is now clearly debunked. “We can now bootstrap learning on very hard problems, providing a direct path to increasingly better models independent of how well humans do on a task. We can do rounds of sampling until we get enough good trajectories, without relying on human annotations or demonstrations. Even more important, this holds on small language models.”

We have some evidence now that we will get to superhuman intelligence on reasoning tasks: “we may be close to a system where you insert your environment and problem set, and you get back a small super-intelligence in that domain. Maybe that whole system is the definition of AGI, or ASI. I don't know. But it feels like we're close to the "intelligence problem" being solved as definitively as protein folding.”

Pharma Deals for TechBio: Part 1 [Aaron Morris, PostEra, Jan 2025]

Aaron Morris, CEO of PostEra has had success expanding AI/platform deals with pharma partners. He takes to this recent blog post to reflect on the strategic considerations biotech founders face when deciding whether to partner with pharma in the first place. Large technology collaboration deals—multi-year, multi-target agreements with upfront payments, milestones, and royalties—can provide a crucial boost, something many techbio founders will use to raise a round or further development, but they also shape a company’s trajectory in a way that is hard to walk back from. He lists five main benefits of a pharma deal, each categorized by whether the impact is felt in the short run (<3 years), long run (>IPO), or somewhere in between:

Platform Validation (short) – Deploying a technology in a real-world pharma program is a critical proof point, especially in capital-intensive fields like AI-driven drug discovery.

Differentiation (short) – Securing a deal signals credibility, but this advantage diminishes as the market matures.

Front-End Economics (medium) – Upfront payments provide rare non-dilutive funding, offering a financial cushion against volatile investment cycles and the Series A chasm.

Back-End Economics (depends on business model)– The big milestone and royalty figures in the headlines are tempting, but control over outcomes is limited—if pharma kills the program, those potential earnings vanish. Be careful here!

Platform Improvement (long)– If structured well, these deals can help strengthen a company’s core technology, fueling a cycle of better performance and future deals.

A crucial point Aaron brought up that founders should really spend time with is: Are pharma deals a core pillar of your business model, or just a means to an end? Many early biotech companies pivoted away from their initial strategy, learning the hard way that the wrong model can be just as deadly as a scientific failure. His next post will cover how to broker and navigate such pharma deals.

Vertex Announces FDA Approval of JOURNAVX™ [Vertex Pharma, Jan 2025]

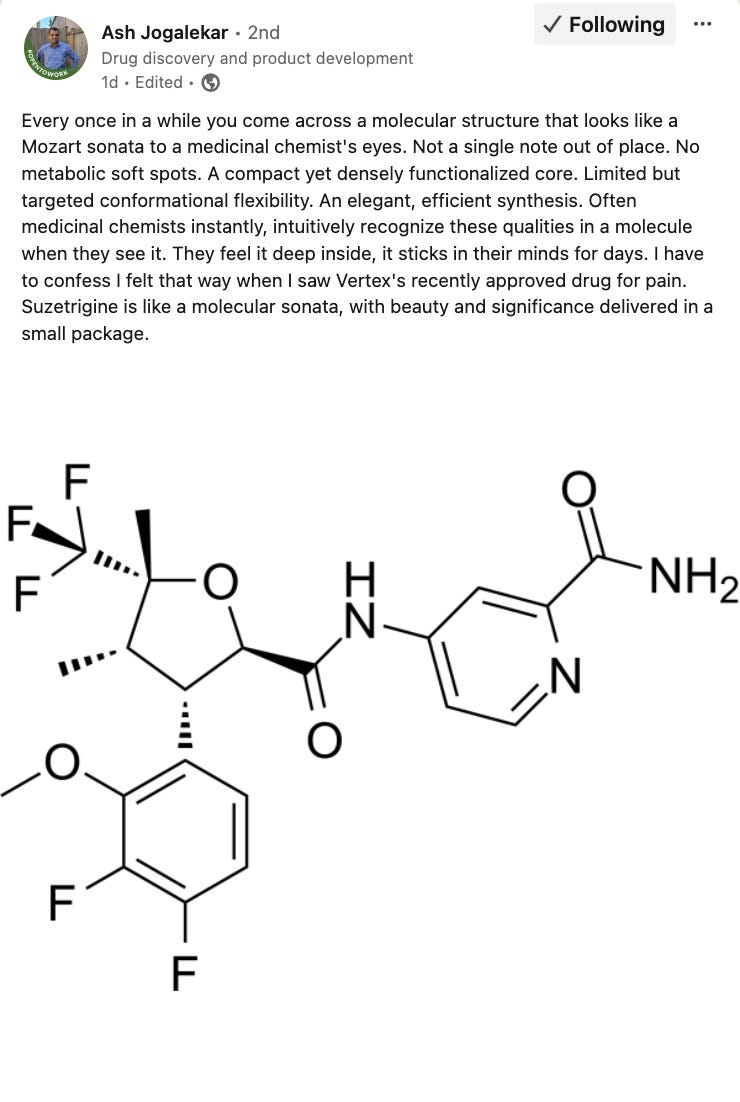

After decades of research post acquisition of Aurora Pharma in the early 2000s, Vertex Pharmaceuticals has secured FDA approval for Journavx, a non-opioid painkiller for acute pain such as post-surgical discomfort. The drug, which targets Nav1.8 ion channels, offers effective relief without the addictive risks of opioids, making it the first new class of pain medicine approved in over 20 years. While data in a trial comparing Journavx against Tylenol and hydrocodone (a commonly prescribed opioid) showed mixed results, Vertex is positioning the drug around its non-addictive potential and greater safety profile rather than outright efficacy superiority.

However, Vertex’s long-term success in pain management depends on securing approval for chronic pain. The acute pain market is limited, and insurers may be reluctant to cover a $31 per day drug when alternatives cost as little as $15. Chronic pain, which affects millions of Americans, represents the real commercial opportunity, yet Vertex’s push into this market remains uncertain. A Phase 2 trial for suzetrigine (VX-548) in sciatica failed to outperform placebo, sending Vertex’s stock tumbling and raising doubts about whether its broader pain franchise can succeed in the chronic setting. While the company argues that trial design adjustments could help in Phase 3, placebo responses have historically confounded pain drug development, making regulatory approval far from guaranteed.

Papers

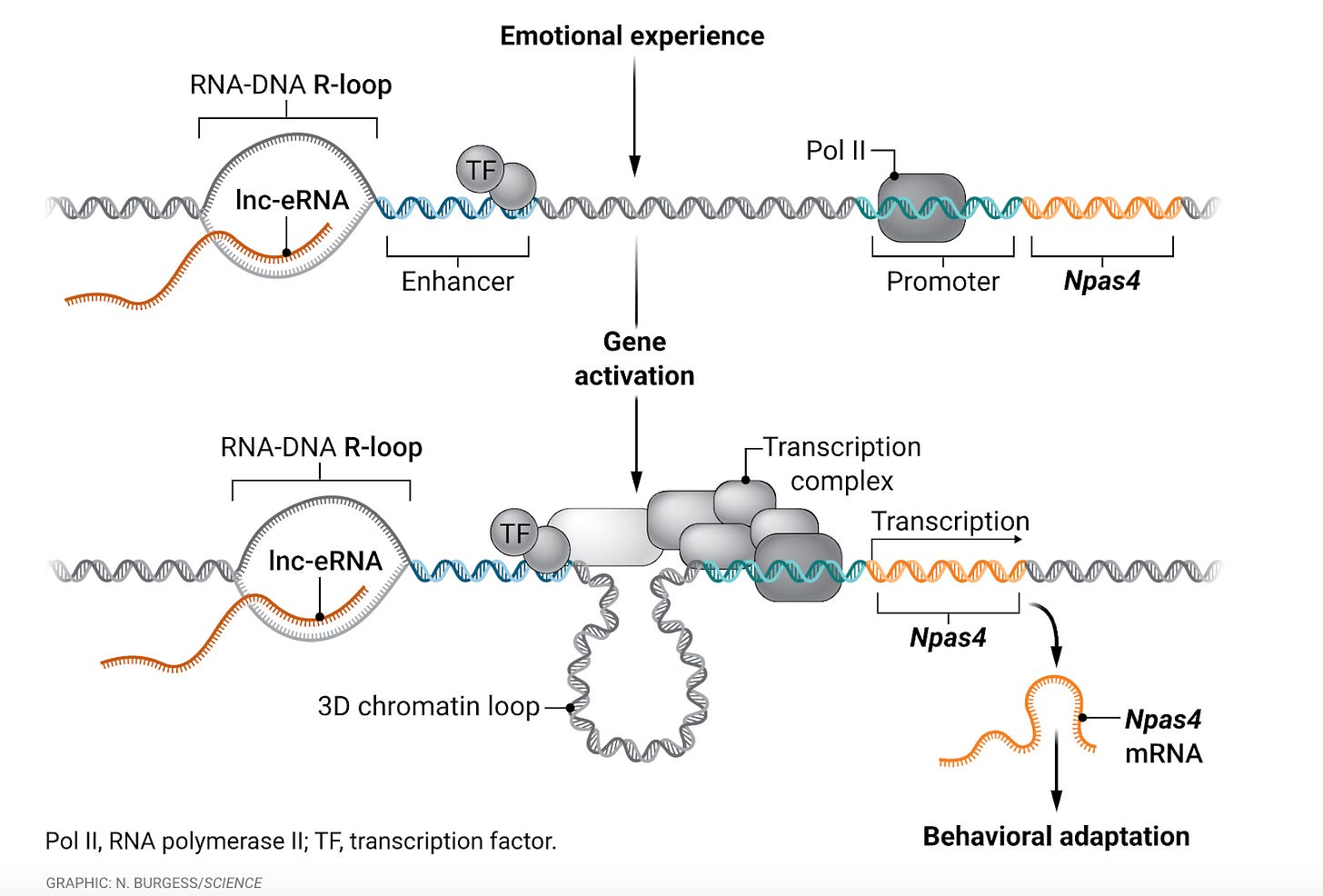

A neuronal gene that loops the loop [Czarnecki & Heller, Science, December 2024]

In a recent study, Akiki et al. make strides in uncovering the underlying mechanism of Npas4 expression (neuronal PAS domain protein 4), shedding light on its role in certain complex psychiatric disorders, including addiction and depression. Due to its established role as a regulator of other neuronal genes, understanding the expression of Npas4 is critical, particularly due to its implications in neuronal communication, brain function, and plasticity. Akiki et al. found that after exposure to stimuli that induce epigenetic changes, Npas4 is transiently expressed due to the presence of a long, non-coding RNA that forms an R-loop, which subsequently results in the formation of a 3D chromatin loop that joins the gene’s enhancer and promoter regions. This form of expression was previously observed in rats with ischemic injury and later replicated after exposure to drugs or stress, but the mechanism of expression was unknown.

Despite being relatively widespread and emotionally debilitating, psychiatric disorders are largely understudied/research is largely underfunded due to their inherent complexity and stigmatization. Especially due to emerging research regarding the importance of R-loops, Akiki et al.’s findings are vital not only to the overall understanding of underlying brain mechanisms, but also hopefully open the door for new therapeutic approaches treating a variety of intractable psychiatric disease indications.

Notable deals

Manas AI, co-founded by oncologist Dr. Siddhartha Mukherjee and LinkedIn co-founder Reid Hoffman, is a startup aiming to revolutionize drug discovery through artificial intelligence. The company recently secured $24.6 million in seed funding from investors including General Catalyst and Greylock (Reid Hoffman’s investment fund).

Leveraging a full-stack platform, Manas AI focuses on large-scale screening and lead optimization to accelerate the development of new therapies. One of their key initiatives, Project Cosmos, delves into the principles of drug binding, aiming to enhance the precision and efficacy of potential treatments.

Lindus Health raises $55M to ‘fix the broken clinical trial industry’

Lindus Health, a London-based startup backed by Peter Thiel, has raised a $55 million Series B to modernize the clinical trial industry with its AI-driven, end-to-end platform. Calling itself the “anti-CRO”, Lindus streamlines trial design, patient recruitment, and data collection, reducing the inefficiencies that slow drug development. With plans to expand to the U.S., invest in AI-driven analytics, and support the growing AI drug discovery ecosystem, Lindus aims to remove clinical trials as the bottleneck to medical innovation.

Metsera ($MTSR) and Maze ($MAZE) have successfully priced their IPOs and begun trading, raising $275 million and $140 million, respectively. Metsera is capitalizing on the booming obesity market with a lead Phase 2b GLP-1 receptor agonist and a Phase 1 amylin analog, backed primarily by ARCH Venture Partners and Alphabet’s GV. Maze is focused on kidney disease, with a Phase 2 small molecule targeting APOL1 as its lead candidate. Both biotechs check key boxes for public market appeal: clinical-stage assets, high-profile investors, and near-term readouts that could drive significant valuation shifts.

What we liked on socials

What we listened to

Events

Field Trip

Did we miss anything? Would you like to contribute to Decoding Bio by writing a guest post? Drop us a note here.