JPM-Byte 2026

A byte-sized recap of select deal & financing announcements around the JP Morgan Healthcare Conference (2026).

Welcome to Decoding Bio’s BioByte: each week our writing collective highlight notable news—from the latest scientific papers to the latest funding rounds—and everything in between. All in one place.

Deals

NVIDIA and Eli Lilly unveil $1B collaboration to build an AI co-innovation lab focused on reinventing drug discovery. AI’s integration and rapid deployment within the life sciences has very clearly positioned as the frontrunner topic of conversation this JPM week. This is in no doubt aided by the announcement on Monday of the exciting new partnership between the two behemoths of their respective industries. The aforementioned lab will be based in the San Francisco Bay Area, with construction starting later this year, and will serve as a hub for experts from Lilly and NVIDIA to collaborate on the development of additional tools and models based around NVIDIA’s BioNeMo to dramatically accelerate development of new drugs. NVIDIA’s press release highlights the following quote from Jensen Huang exemplifying the general enthusiastic sentiment around AI’s synergy in biotech:

“AI is transforming every industry, and its most profound impact will be in life sciences…NVIDIA and Lilly are bringing together the best of our industries to invent a new blueprint for drug discovery — one where scientists can explore vast biological and chemical spaces in silico before a single molecule is made.”

Initial work will focus on connecting wet lab efforts to computational ones, enabling a positive feedback loop between the two. This announcement follows Lilly’s TuneLab which launched this past September, demonstrating their enduring commitment to AI in drug discovery and development.

AstraZeneca agrees to acquire Modella AI for an undisclosed amount. The deal follows in the wake of the two companies’ multi-year deal in July of 2025, which granted AstraZeneca access to Modella’s AI foundation models to assist in the development of their oncology assets. Under the acquisition, these models will be further integrated into AstraZeneca’s oncology-related workflows, facilitating greater efficiency, insights, and development speed.

Tahoe Therapeutics, the Arc Institute, and Biohub announce a partnership to build the most comprehensive dataset for virtual cell models. Independently, the organizations have all made profound strides towards simulated cell behavior—from Tahoe’s Tahoe-100M to Arc’s scBaseCount and Biohub’s CELLxGENE—but the joint effort will reach even greater heights. As agreed upon by the three companies, the new dataset will be four times as perturbation rich as Tahoe-100M, building on previous learnings to produce data that is more clinically relevant and captures greater cell and perturbation diversity.

Illumina announces the first tranche of their 5 billion cell atlas, called the Illumina Billion Cell Atlas. Built from a set of 200 disease-relevant cell lines, the Atlas seeks to systematically map how cells respond to genetic modifications made via CRISPR technology. Over the next three years, Illumina will produce annually 20 petabytes of single-cell transcriptomic data, amounting to five billion total mapped cells. Data generation and processing at this scale are made possible by their Single Cell 3’ RNA prep platform and DRAGEN pipeline respectively. AstraZeneca, Eli Lilly, and Merck have already signed on as early participants.

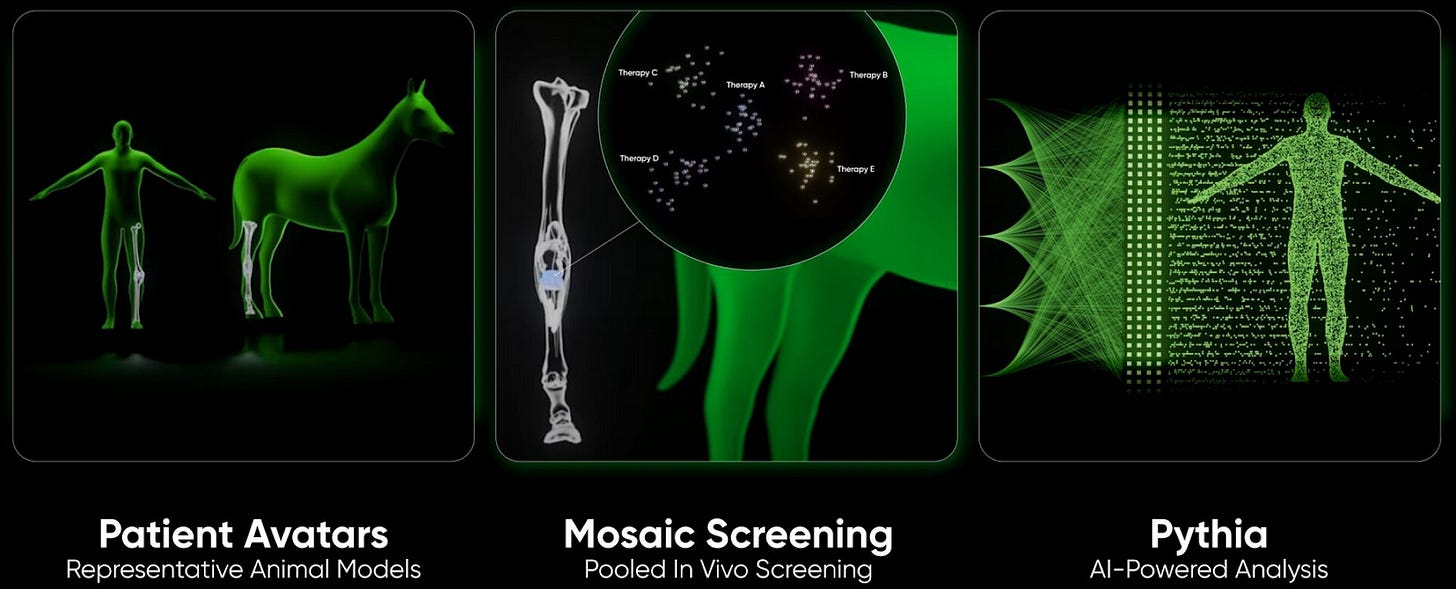

Gordian Bio enters research collaboration with Pfizer for obesity target discovery. The non-exclusive agreement applies Gordian’s large-scale in vivo mosaic screening platform to identify novel therapeutic targets within visceral adipose tissue – a fat depot central to metabolic dysfunction but notoriously difficult to study outside the body. The partnership reflects pharma’s search for novel mechanisms post-GLP-1, with particular interest in obesogenic memory and adipocyte-focused biology. Financial terms were not disclosed.

Cellino and Polyphron partner to build end-to-end infrastructure for personalized tissue replacement. The strategic collaboration pairs Cellino’s AI-guided iPSC manufacturing platform with Polyphron’s autonomous tissue foundry to address the core constraint that has kept regenerative medicine from scaling: manufacturing. Cellino produces patient-derived induced pluripotent stem cells using lasers, image-based AI, and closed cassette systems. Polyphron then engineers those cells into functional tissues using closed-loop optimization and non-destructive phenotyping.

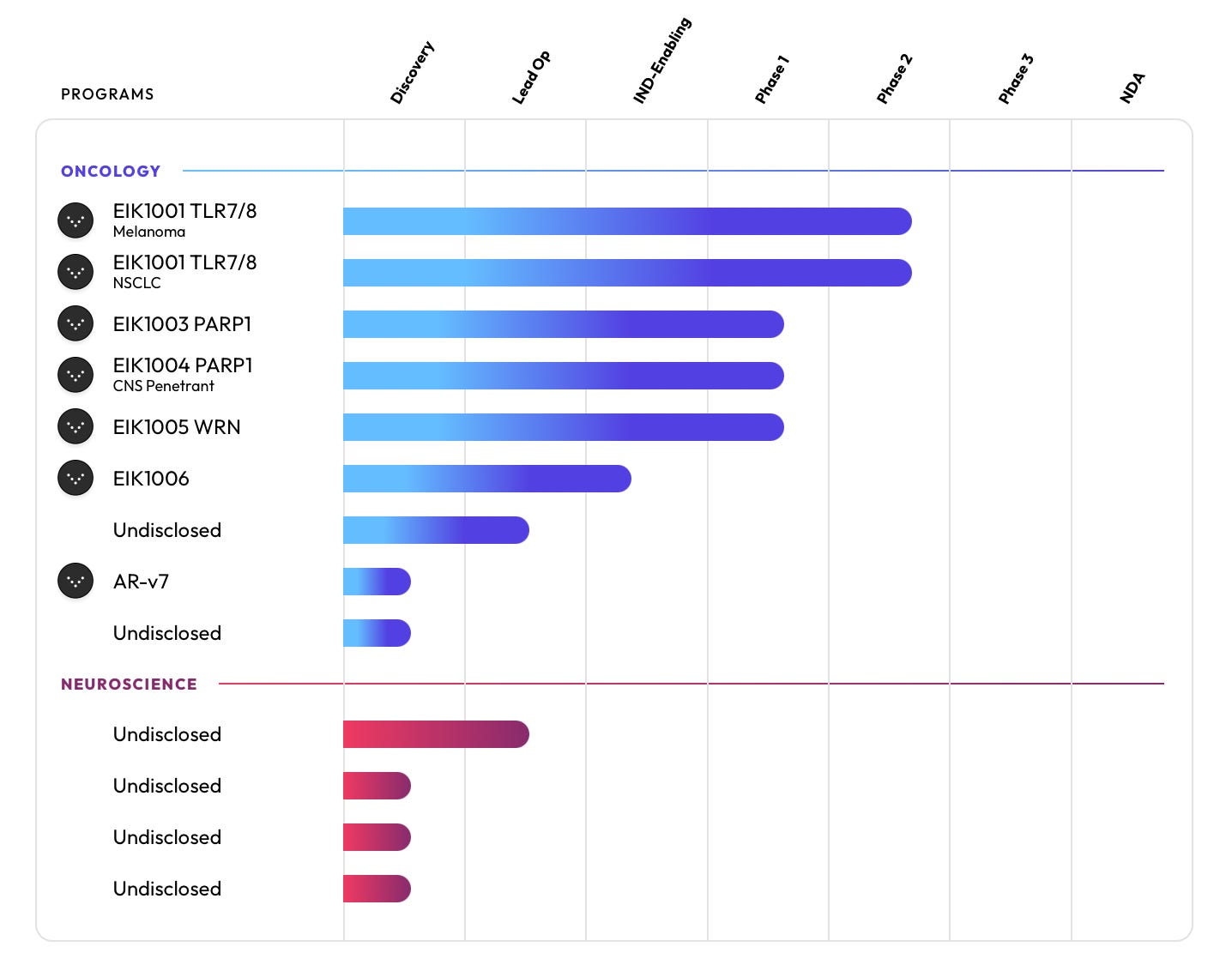

Eikon Therapeutics filed a preliminary prospectus with the SEC for their potential IPO on the Nasdaq Stock Market. As the filing is only preliminary, many details are unclear such as the number of shares to be sold and the share price. Proceeds of the IPO would be put towards advancing the company’s four clinical programs. EIK1001 is in two Phase II/III trials, one as a combination therapy with Keytruda for advanced melanoma and the other for non-small cell lung cancer. EIK1003 is in Phase I/II for breast, ovarian, pancreatic, and prostate cancers, as is EIK1004. The latter is also being investigated for its applications in brain metastases and malignancies. The fourth asset is EIK1005, currently in Phase I/II for advanced solid tumors.

Benchling and Lilly TuneLab partner to democratize AI model access for scientists. The strategic collaboration makes AI models trained on over $1 billion in Lilly’s proprietary research data accessible directly within scientists’ existing Benchling workflows. Through the integration, Benchling’s customer base of more than 1,300 biotech companies will be able to run Lilly TuneLab prediction models for antibodies and small molecules, and share data back for federated learning. The partnership joins Benchling’s existing AI collaborations with Anthropic and NVIDIA, further positioning the platform as the infrastructure layer where scientists access leading AI models alongside structured data.

Raises

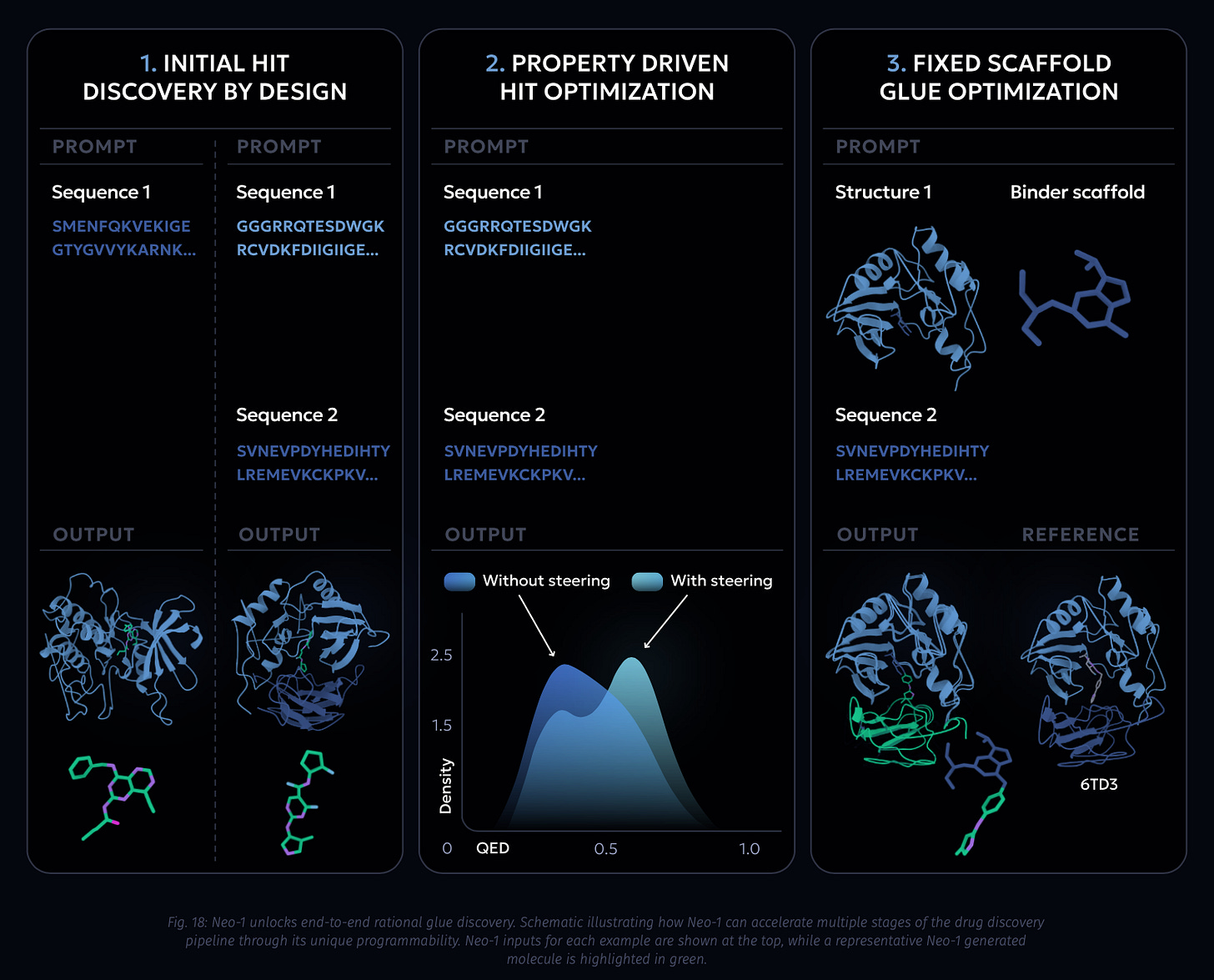

Proxima (previously VantAI) secures an $80M seed round led by DCVC to target proximity-based therapeutics. The rebrand comes as an alignment with the company’s professed goal of building out the data and technological infrastructure needed to study and develop medicines that address the human interactome, a vastly under-studied space. With only 5% of protein-protein interactions structurally characterized, Proxima asserts this space to be the next focus area for therapeutic development. The company’s crowning accomplishment is Neo-1, a foundation model which “unifies structure prediction and molecular design at an atomic level, allowing prompting with multimodal and fine-grained structural information both for individual molecules and their interactions.” The model is additionally able to be integrated with their cross-linking mass spectrometry (XLMS) platform, NeoLink, allowing for acceleration of collection of structural data, crucial for designing effective molecules and predicting intermolecular interactions. Proxima already has a promising track-record given prior partnerships with Bristol Myers Squibb, Johnson & Johnson, and Blueprint Medicines (acquired by Sanofi). Other investors in the round were AIX Ventures, Alexandria Venture Investments, Braidwell, Magnetic Ventures, Modi Ventures, NVentures, Roivant, Yosemite and various institutional investors.

Vibrant Therapeutics raises $61M for the continued development of their pipeline and platform. The company’s lead asset, VIB305, recently had itsIND application approved by the FDA for EGFR-positive solid tumors. The asset employs a logic-gated approach to specifically activate within the tumor microenvironment, protecting healthy cells. New investors Apricot Capital and Pfizer Ventures alongside Bayland Capital, First Principle Venture Limited, HSG, and Northern Light Venture Capital participated in the round, bringing Vibrant’s total raised to $100M.

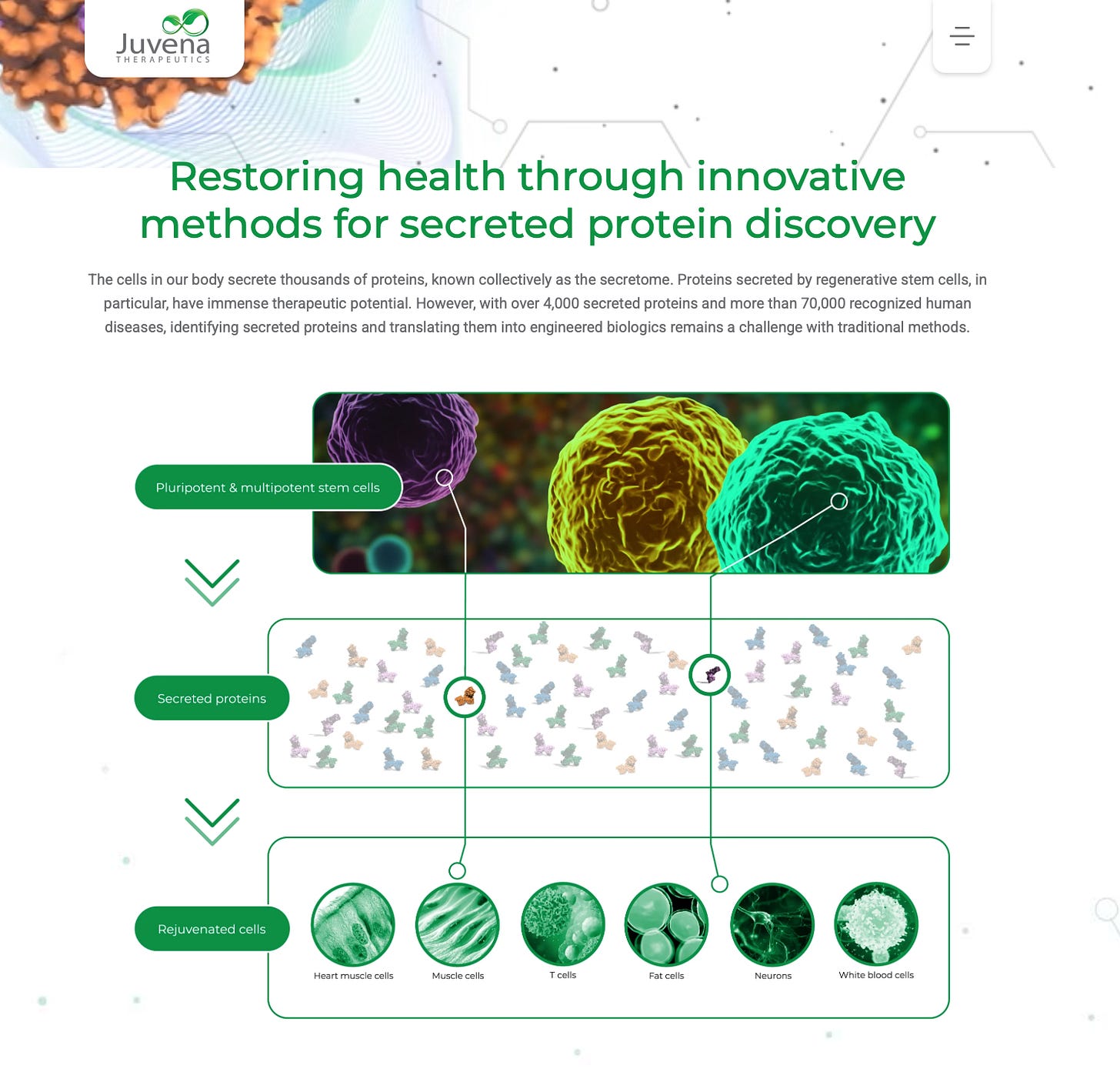

Juvena Therapeutics raises $33.5M Series B led by Bison Ventures. The round will be used to support further development of clinical assets, the continued expansion of their pipeline, and efforts to improve their AI capabilities. Juvena’s lead asset, JUV-161, is currently in Phase I clinical trials for myotonic dystrophy type I and sarcopenia and acquired myopathies with final readouts expected before the end of January. Juvena had also recently announced an up to $650M collaboration with Eli Lilly to improve body composition and muscle health.

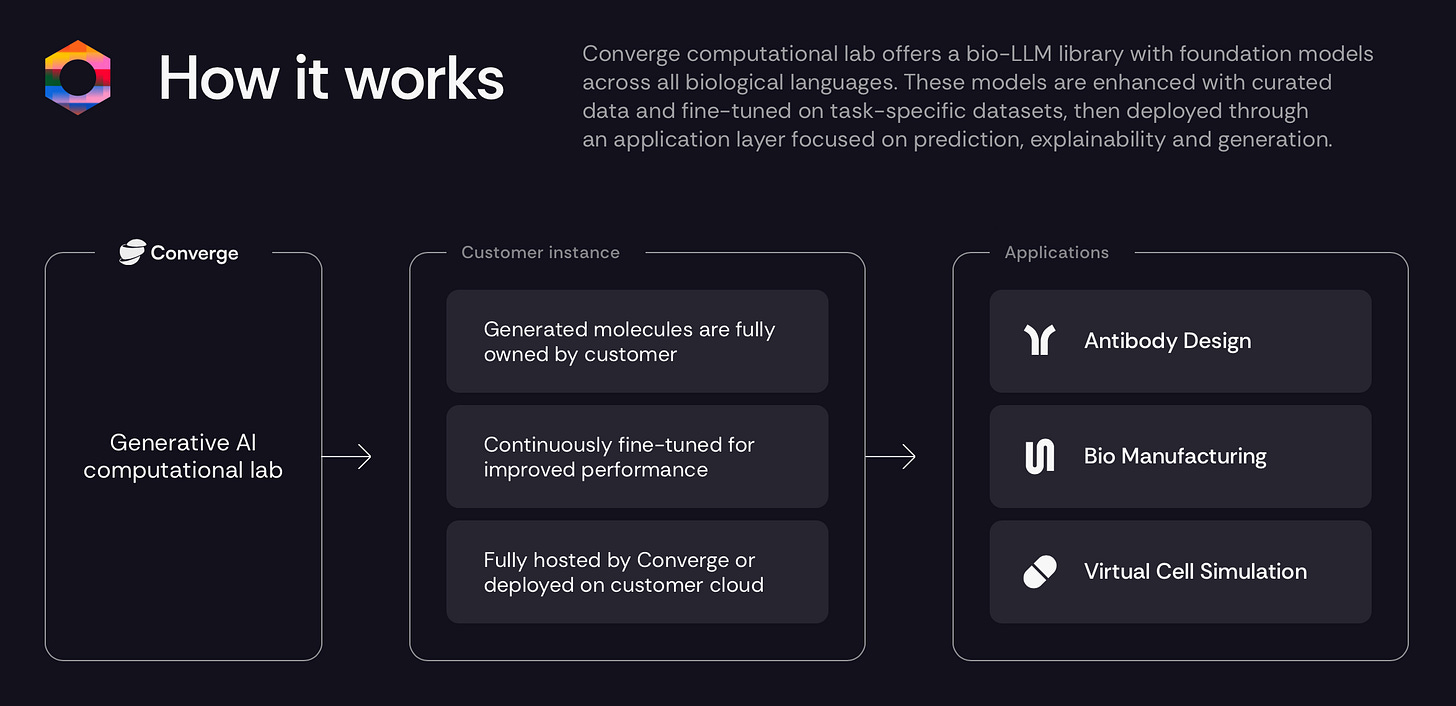

In their oversubscribed Series A led by Bessemer Venture Partners, Converge Bio raises $25M. Converge builds systems of models easily integratable into existing workflows to accelerate drug discovery for biotechs and pharma alike. So far, the models span antibody design, biomarker/target discovery, and protein yield optimization and have been used across 40 programs within 12 companies. Other investors in the round were Saras Capital, TLV Partners, and Vintage Investment Partners with additional support from executives at Meta, OpenAI, and Wiz. The round follows their $5.5M seed raise in 2024.

Trailhead Biosystems announces a $20M extension of their raise from May of last year, led by MAK Capital. Through their High-Dimensional Design-of-Experiments platform, Trailhead has developed an expertise in the differentiation of induced pluripotent stem cells (iPSCs). Their efforts transform the iPSCs into functional human cell types for all types of applications, reducing the prevalence of animal testing while simultaneously producing more translationally-relevant data. The funds from the extension will support internal development efforts to improve the quality and robustness of Trailhead’s human cell models.

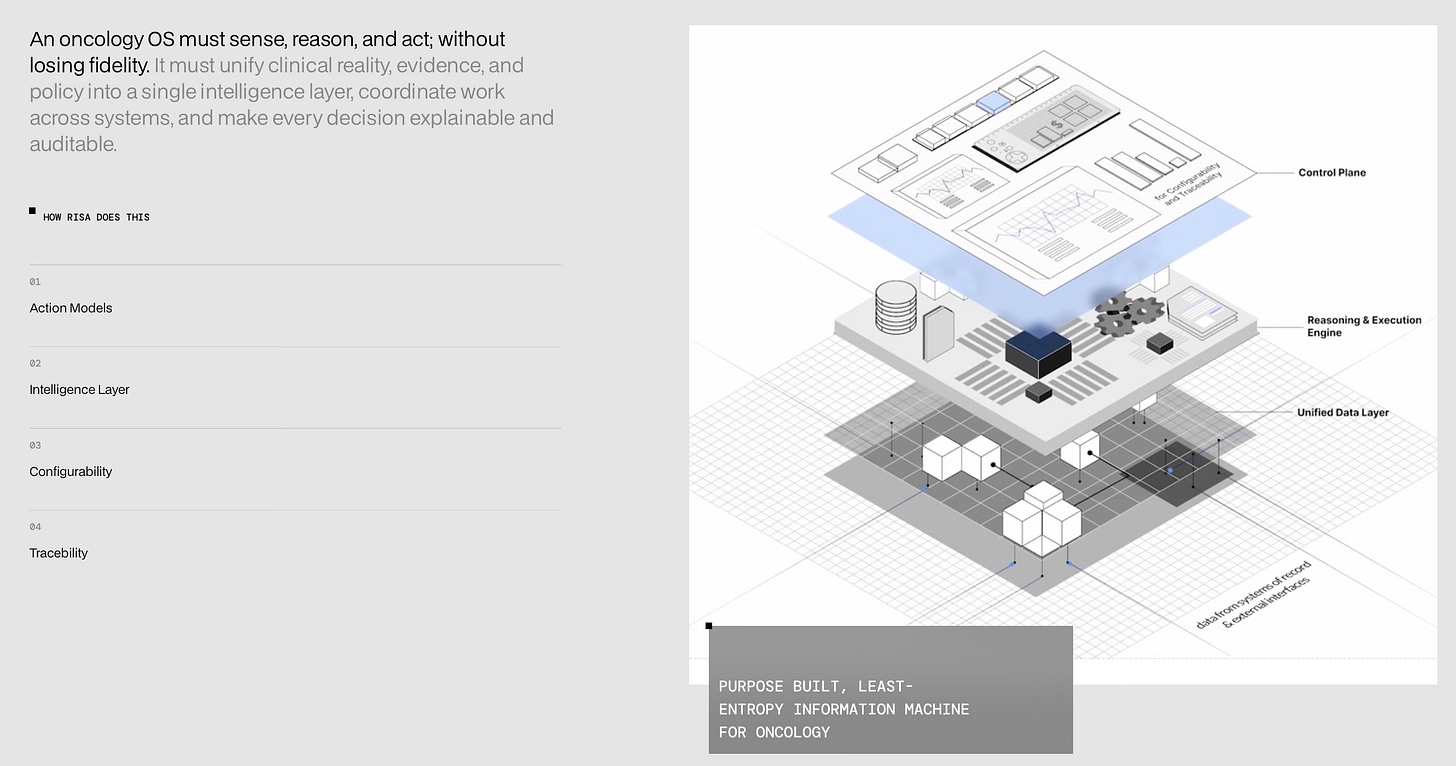

RISA Labs closes $11.1M Series A co-led by Cencora Ventures and Optum Ventures. The company has developed a team of AI agents which streamline ever-changing operational processes present in cancer treatment, freeing up FTEs and accelerating patient access to potentially life-saving care. Funds from the round will be deployed to bring RISA’s product to cancer clinics, health systems, infusion networks, and specialty pharmacies. Oncology Ventures, Z21 Ventures, and John Simon (co-founder of General Catalyst) were also investors in the round.

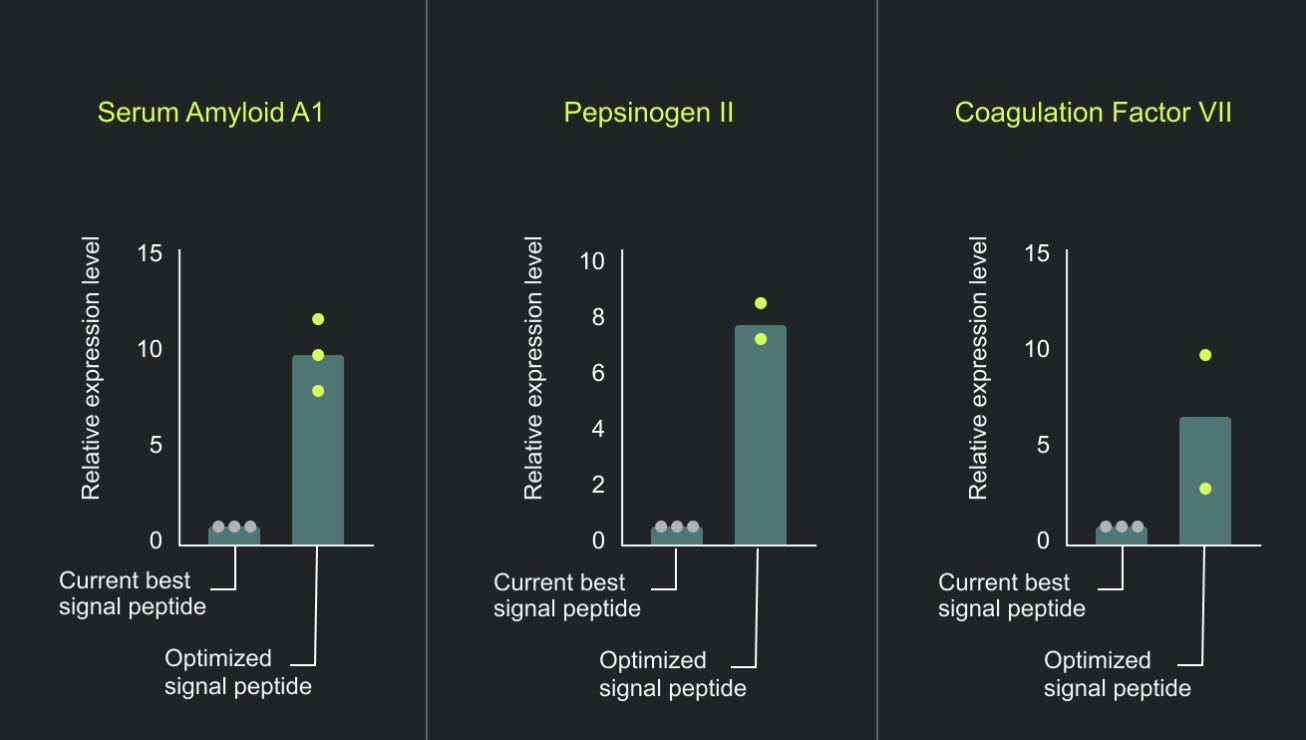

Avenue Biosciences obtain a $5.7M seed extension, co-led by Balnord and Tesi. Using their library of signal peptides, the company seeks to greatly improve the manufacturing of therapeutically-relevant proteins. The current understanding of the secretory pathway and diversity of signal peptides used are very limited, which is something Avenue seeks to remedy. In doing so, they hope to greatly increase the accessibility of difficult-to-manufacture proteins, bringing therapeutics to those in need. Dimerent, Inventure, University of Helsinki, Voima Ventures participated in the round, which brought the total raised to $8.7M since 2024.

Allos AI announces a $5M seed round to commercialize their AI platform to reformulate small-molecule drugs. The formulation of drugs is rarely revisited once approved, even when the drug is taken generic, even when the formulation is evidentially subpar. Allos’ Causal AI platform seeks to enable this reformulation, improving medicines even after they have been approved for use. Given the potential immediacy of the impact, Allos believes this to be the most significant near-term opportunity for AI in the drug discovery process. The round was led by Oxford Science Enterprises while Berkeley SKYDECK, Habico Invest, and the family office of Danish pharmaceutical group Orifarm participated.

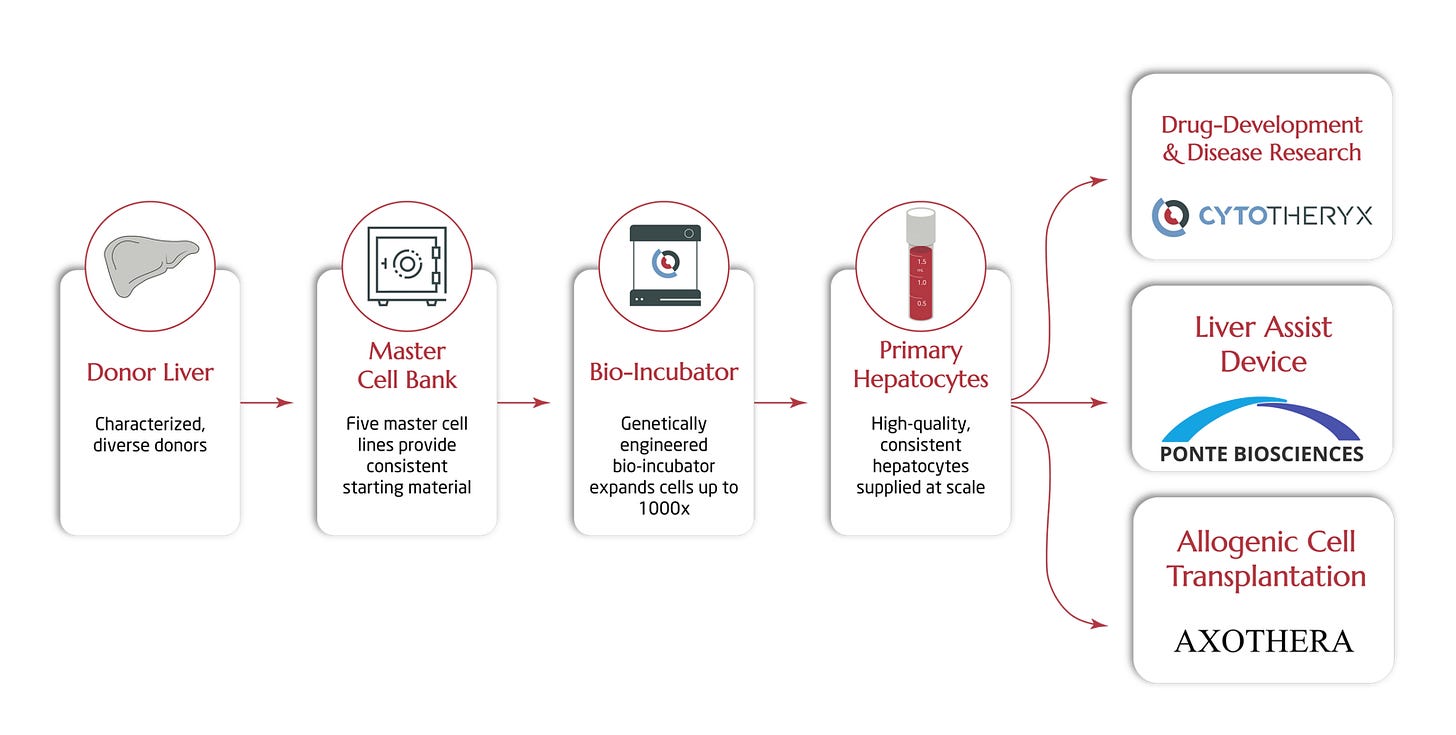

Cytotheryx raises a $60M Series A, led by Ouroboros Family Founders Fund I, LP. The funding will be used to promote several of their hepatocyte-based treatments to the clinic for acute, chronic, and rare liver diseases. The company has also secured debt financing from QRS Investments, to be put towards GMP manufacturing, expansion of real estate, and operational scale-up.

Kinaset Therapeutics raises a $103M oversubscribed Series B, co-led by Forge Life Science Partners and RA Capital Management. The raise will be used to support the Phase II trials of their lead asset, frevecitinib, for patients with severe asthma. Frevecitinib is a JAK inhibitor designed to be inhaled as a dry powder to deliver necessary therapeutic dosages while limiting systemic exposure. Other investors in the round included 5AM Ventures, Atlas Venture, EQT Life Sciences, Gimv, Pictet Alternative Advisors, Schroders Capital, Sixty Degree Capital, Vivo Capital, and Willett Advisors.

Nuclera raises $12M to extend its Series C to $87M. The financing was led by Elevage Medical Technologies and Jonathan Milner, with participation from existing investors British Business Bank and GK Goh. Proceeds will accelerate the development of full-format antibody expression, purification, and binding validation capabilities, addressing a key bottleneck in biologics R&D. Since its prior Series C close in 2024, the company has added membrane protein workflows, extended its footprint into APAC and the Middle East, and initiated a collaboration with Cytiva.

Mirador Therapeutics closes a $250M Series B round to establish proof of concept for current assets and further expand their pipeline. The company—which focuses on immune-mediated inflammatory and fibrotic diseases—has assets in clinical trials for indications across Crohn’s disease, idiopathic pulmonary fibrosis, rheumatoid arthritis, and ulcerative colitis. Investors in this round included Adage Capital Partners L.P., ARCH Venture Partners, Blue Owl Healthcare Opportunities, Boxer Capital, Fairmount, Farallon Capital Management, Fidelity Management & Research Company, Invus, Logos Capital, Moore Strategic Ventures, OrbiMed, Point72, T. Rowe Price Investment Management, Inc., TCGX, Venrock Healthcare Capital Partners, and Woodline Partners LP. Mirador’s Series B brings the company’s total raised to $650M since their launch in March of 2024.

Caldera announces their launch with $112.5M in capital across Series A and Series A-1 raises. Funds will be used to further the Phase I trials of their lead asset, CLD-423, in inflammatory bowel disease and other immunologic and inflammatory diseases. The asset is a bispecific antibody which targets IL-23p19 and TL1A pathways. The Series A, which took place in April 2025, accounts for $75M of the announced value, while the Series A-1, led by Omega Fund, constitutes the other $37.5M.

Lux Capital closes $1.5B ninth fund, the largest in its 25-year history. The oversubscribed fund – which turned away roughly $1B in excess demand – will target companies pursuing breakthroughs across physical, computational, and life sciences, with particular emphasis on defense, aerospace, AI, robotics, and energy. The raise underscores a shift in private markets as venture capital increasingly aligns with national security priorities, changing how risk and return are evaluated in an era of heightened geopolitical tension.

In case you missed it

some exciting pre-JPM raises and launches:

Beacon Therapeutics Announces Closing of Oversubscribed Series C Financing for Over $75 Million

bit.bio secures $50 million Series C to scale human cell programming technology

Enodia Therapeutics Secures €20.7M to Advance a Small-Molecule Platform

Orca Bio Announces $250M in Aggregate Financing in Preparation for Potential Commercialization

Topos Bio Secures $10.5M to Tackle ‘Undruggable’ Proteins Driving Alzheimer’s and Cancer

Vizgen Announces $48 Million Financing

Socials

Field Trip

Did we miss anything? Would you like to contribute to Decoding Bio by writing a guest post? Drop us a note here or chat with us on Twitter: @decodingbio.

Very comprehensive

Fantastic roundup of JPM announcements. The Gordian Bio-Pfizer collaboration for in vivo target discovery in visceral adipose tissue really stands out as a smart bet on what comes after GLP-1s. The fact that pharma is actively hunting for obesity mechanisms beyond incretins suggests we're finally taking seriously how little we undestand about adipocyte biology and metabolic memory. I worked on a similar screening project in grad school and the technical challenge of studying visceral fat depots outside the body is genuinley brutal.