Going Zero to One in TechBio: Five Lessons from Waypoint Bio CEO and Co-Founder, Xinchen Wang

5 lessons on how to navigate challenges when building a bio platform from scratch

Welcome to Decoding Bio, a writing collective focused on the latest scientific advancements, news, and people building at the intersection of tech x bio. If you’d like to connect or collaborate, please shoot us a note here. Happy decoding!

We’re thrilled to bring you the first long read from our collective, written by Xinchen Wang. Xinchen is co-founder and CEO of Waypoint Bio, a seed-stage biotech startup optimizing solid tumor cell therapy designs using spatial biology. Prior to Waypoint Bio, Xinchen was a PhD student at MIT and the Broad Institute working on computational biology, genomics and building new genomics technologies, and a postdoc at Columbia University on human genetics. Waypoint Bio was started in 2021 by Xinchen and his co-founder & CSO David Phizicky, who met as PhD students (and roommates!) at MIT. Waypoint Bio went through a pivot in early 2022, and this article is focused on their considerations in designing the platform. Hummingbird is an investor in Waypoint Bio.

In early 2022, after extensive research and customer discovery interviews with scientists and directors in biotech and pharma, we pivoted from our original idea. We started off building a company focused on human genetics-driven target discovery and validation and modified our platform for optimizing solid tumor cell therapy designs using spatial biology. We wrote this document for new founders just starting out, or existing bio startups considering a pivot.

It's the document we wish we had read before designing our platform, which would have saved us a year of time, money, and effort.

Here are five lessons we’ve learnt in the past couple of years:

1. Be careful of spinning out your PhD/postdoc project

While spinning out your academic research might seem like a natural next step in your career, it's important to exercise caution. It can be highly advantageous to spin out your project and give your company some extra credibility via data, publications and credentials, but first carefully consider the specific project you're looking to spin out - does it have the potential to become a viable and compelling biotech platform?

Spinning out is perfect for those that spent years working on a biotech-ready project. However, don't try to force it if there's no fit. If you didn’t specifically choose your lab and project with the goal of spinning out a startup in mind, it's unlikely your project from academia is the right one to launch a startup on.

When we started Waypoint, we focused exclusively on areas we were already familiar with (e.g. genetic diseases), and could’ve saved a lot of time by branching out earlier. This is especially true if your research was more basic science-oriented - e.g. studying how phosphorylation of protein X affects cancer. In most cases, unique domain knowledge about a signaling pathway won’t make for a strong techbio platform. Similarly, if you started your academic work several years ago, your timing might be wrong and it might be difficult to find a place for your company in the current landscape.

As more and more PhD students & postdocs look to create biotech startups, it's likely that many founders will be starting companies with new ideas, rather than trying to spin out their academic work.

While your specific academic project may not be suited for a biotech startup, it can be incredibly valuable to transfer your unique skills to your company. In particular, operating at the intersection of disparate areas of science can be incredibly impactful, especially if it allows you to address a problem from a fresh perspective or form a unique moat around know-how.

At Waypoint Bio, for example, our platform sits at the intersection of five different areas (pooled screening, genomics technology development, spatial biology, computer vision, and cell therapy). If you don't have transferable skills relevant to the problem you want to solve, it can be helpful to gain experience in the biotech industry or pursue a short postdoc, but with caution that the field may have changed by the time you're ready to start your company. If your past academia work is well-suited for spinning out, the 50Y Spinout Playbook is an amazing resource.

2. Apply the 10X rule: not every important problem is a good startup problem

As a startup, it's crucial to focus on problems that can be addressed effectively with the limited resources you have. Incrementally improving on existing approaches may not be enough, as you may still be at a disadvantage in terms of resources, access to talent, equipment, networking, and knowledge. Instead, if your biotech’s key value is the platform, strive to create a platform that is at least “10X better” than current solutions in a key aspect of your business. This can help compensate for the disadvantages you will encounter.

The “10X better” rule is well-known in the startup world, but we personally found it to be a big shift in thinking compared to academia. In most life science fields, there is no shortage of highly impactful papers that achieve important and impactful results with minimal (if any) technological innovation. One great example are pooled CRISPR screens – these are highly valuable for generating important biological insights, but the technology is now so ubiquitous that a startup building its core platform on pooled CRISPR screens may struggle to attract partnerships and investment.

Alternatively, consider tackling a problem in a completely new way, rather than being 10X better in an existing approach. This can allow you to generate previously inaccessible insights or assets and stand out in a crowded market.

3. Understand what proof points are necessary to convince partners and investors your platform can deliver on its promises

The requirements will vary depending on the specific platform and disease you're targeting. For example, you may need Phase 3 clinical data in humans to demonstrate the efficacy of a new statin drug, while in vitro data benchmarked against existing best-in-class assets may be sufficient to secure a large Series A fundraise for a different modality. The shape of the risk distribution curve is also critical - techbio platforms are often well-suited for problems where most of the risk (technical or partnering) is concentrated in the upfront stages, rather than in the later stage (late stage clinical risk, or commercial risk). As a founder, it's essential to carefully consider what data and proof points are necessary to convince others of your platform's potential, and to focus on problems where your platform can effectively address the key risks and uncertainties.

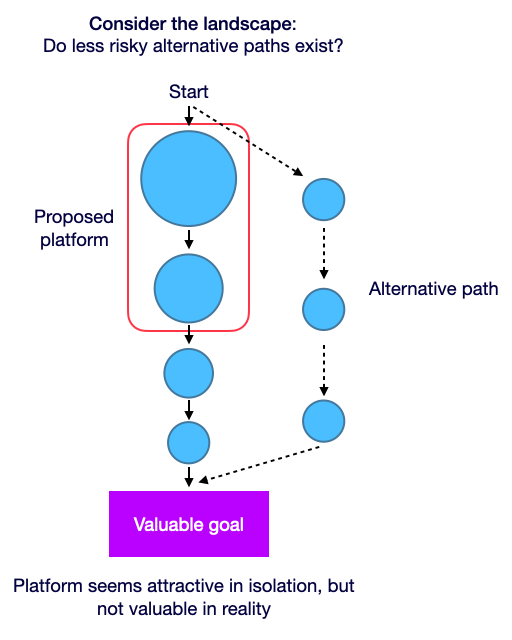

Figure 1. Make sure to map out what proof points your platform will need - can you shift the proof points earlier? Is the key milestone a successful but risky phase 2 trial or can you convince people with well-accepted preclinical models and/or BD traction? Each circle corresponds to a key milestone, and the size of circles corresponds to the risk or difficulty of each step.

It's also crucial to consider how your proof points can impact the timing of your company's success – what readouts (data or BD) can demonstrate the effectiveness of your platform, and how long will it take to gather this evidence? If it takes a long time, will your platform still be valuable in the market five or ten years down the line? Before you achieve your proof points, can readouts from other companies positively or negatively influence how others perceive you?

It's also worth noting that the credibility of your team can play a significant role in the amount of proof investors require before backing your startup. If you spin out from a celebrity lab, investors will be much more willing to take a chance on your startup before the key data readouts. However, if you're starting from scratch with less credibility, it's more important to draw on as much proof as possible from past experiences or consider bringing in external expertise through co-founders or early team members. Ultimately, the key is to carefully consider the proof points you have at your disposal and how they will be perceived by investors.

4. Why do people keep asking about secret sauce?

"Secret sauce" often refers to something unique and valuable you can do that your competitors cannot. Broadly, there are four types of platforms in biotech:

Unique modality (i.e. if you hold key patents on a modality used to treat patients, e.g. CRISPR, prime editing, mRNAs or siRNAs)

Unique biological insight (e.g. drugging metabolism to treat cancer)

Drug delivery platforms and related approaches

Screening platform companies (i.e. those that improve one or more steps of the drug discovery process)

Many techbio startups operate in zone #4 where defensibility can often be found in four key areas: intellectual property, unique know-how, scale, and data. Method-of-use IP used in the screening process (e.g. not used to directly treat patients) might be less defensible because it’s hard to know if someone is infringing. The other three defensibility categories combine to form a barrier through “effort-to-recreate”.

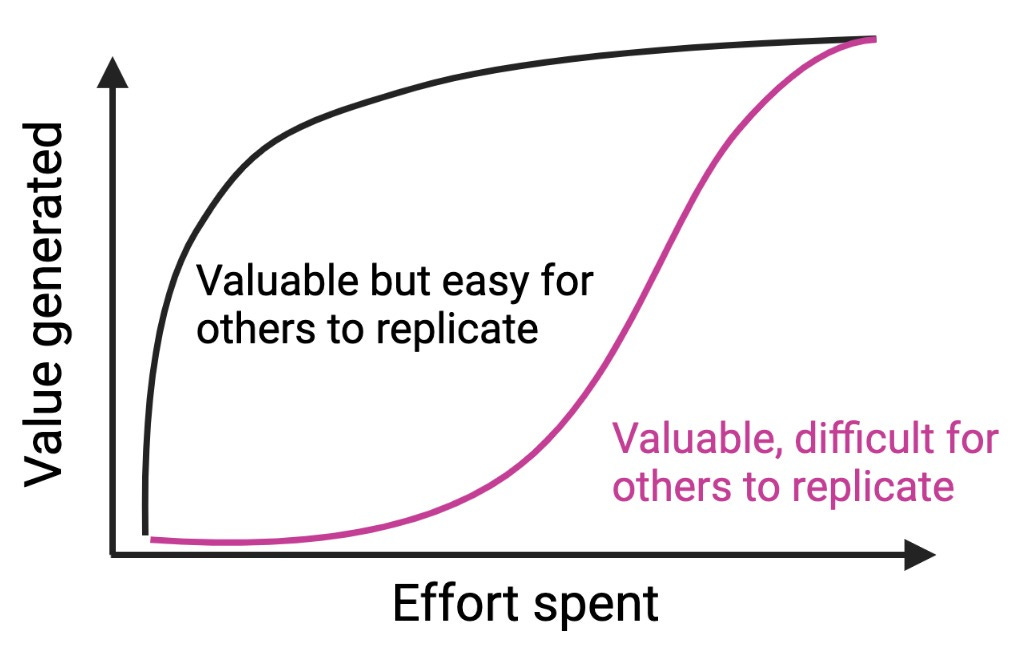

As an example, if you discovered and published an amazing and easy approach to make better cell lines for drug screening, the cost-to-recreate might be so low that every company can start using it overnight and you have no defensibility. The higher the upfront effort needed to recreate your platform’s value (some combination of time, money spent and unique know-how), the more defensible your platform is, assuming there isn’t another, easier path to generating the same value.

Figure 2. Consider the amount of effort needed to generate most of the value of your platform. If it only costs $500k and 6 months to generate 75% of your platform’s value (and $10M and another 5 years for the remaining 25%), your platform isn’t very defensible (black curve). Contrast this to a highly defensible alternative platform where $1M and 1 year gets you only 5% of the value, and you need a dedicated startup to invest many years and many millions of dollars (purple curve) to capture substantial platform value. The Network Effects Manual from NFX is a great resource, and some examples include Waze vs. Yelp, and in the bio space, the purple curve could represent high upfront companies requiring large training datasets, or high infrastructure expenditures (e.g. fragment-based drug discovery)

Scale is particularly important with two main subcategories: scaling through space (e.g. capital expenditures - infrastructure, etc.) and scaling through time (e.g. design-build-test-learn cycles). Scale is great for defensibility if there isn’t a separate, easier way to get to the same value generation (e.g. ability to scale 1-by-1 experiments might lose value if a pooled approach were developed). We also refer to a previous article on achieving defensibility through execution.

5. It’s important to distinguish a more valuable platform from a more complex platform

The ultimate value and goal of defensibility is to be able to develop assets with lower failure rates or at lower cost (costs may be higher initially until the data network effects start to be valuable). The initial set up process typically requires high effort spent - both on time (e.g. number of iteration cycles) and cost (cost per iteration cycle), but this is only important when platform complexity & greater effort-to-recreate is necessary to generate value. More or fancier features don’t matter, only what new solutions they enable.

Figure 3. More complex isn’t always better. Make sure to choose a problem where more complex is necessary to drive value, and there isn’t an easier, more elegant alternate path to your goal. Each circle corresponds to a key milestone, and the size of circles corresponds to the risk or difficulty of each step.

Cost-to-recreate should also include whether new technologies will emerge in the near future that reduce effort spent for future competitors, and whether your know-how or proprietary datasets might be released from other venues. Some examples are:

Generating an “atlas of data” might seem compelling for establishing long-term data defensibility, but you should assess whether others can generate similar atlases. A company with data defensibility built on proprietary patient RNA-seq data may face challenges if an academic consortium is also generating their own atlas for the patient population, or if others can create similar data by mining and compiling all the public databases of RNA-seq data. This is also affected by the progressive drop in sequencing costs.

Myriad Genetics had built value in proprietary databases of variant functions for genetic mutations in BRCA1/2 for breast & ovarian cancer, generated by extensive natural history studies of patients. Besides the famous Supreme Court case, the value of these proprietary databases were reduced when crowdsourcing efforts compiled reports from thousands of patients that received Myriad reports (e.g. effectively making parts of the database public), and when saturation mutagenesis was performed, allowing functional assays to reach the quality of natural history databases and when guidelines allowed functional assays to be used to assess variant pathogenicity.

Complete Genomics offered fee-for-service genome sequencing where you shipped samples to their labs, but this was later out-competed by Illumina, Life Technologies and Roche that sold the high-throughput sequencers directly to the customer.

A startup focusing on autologous cell therapy manufacturing could face landscape-shift challenges from both allogeneic cell therapy technologies and in vivo mRNA cell therapy production.

Some final words

It’s easy to design a platform, but building an important, differentiated and defensible platform takes time and lots of thought. We found it helpful to map out what other companies are working on, and try to understand why they chose their specific problem. In pivoting and developing our platform, we studied the websites, press releases and public filings for hundreds of biotech startups, and spoke with numerous founders to try and understand how they chose their problem and platform. Even if you feel that your academic project isn’t a fit for a biotech startup, you and your future co-founders likely have some unique combination of skills that can be applied to a compelling startup. In evaluating this, don’t be afraid to venture outside of your scientific comfort zone into new technologies or new modalities!

Would you like to contribute to Decoding Bio by writing a guest post? Drop us a note here or chat with us on Twitter: @ameekapadia @ketanyerneni @morgancheatham @pablolubroth @patricksmalone

Very glad you made the distinction here that this is a process for Tech Bio.

I'm wanting to note, making the start of the process more complicated perpetuates high development costs, which are known to be a difficulty in bio in general.

How would you develop tech bio in ways that lower development costs, to make important discovery more accessible, more affordable, although as you say must probably less value for the sector?

What would the Facebook equivalent be for Tech Bio that starts unlocking doors for large majorities?

Very glad you made the distinction here that this is a process for Tech Bio.

I'm wanting to note, making the start of the process more complicated perpetuates high development costs, which are known to be a difficulty in bio in general.

How would you develop tech bio in ways that lower development costs, to make important discovery more accessible, more affordable, although as you say must probably less value for the sector?

What would the Facebook equivalent be for Tech Bio that starts unlocking doors for large majorities?