BioByte 095: Using autrotrophs for food production, the future of computational drug discovery, calls for a CRISPR revolution, a proteogenomic pipeline for neoantigen discovery

Welcome to Decoding Bio’s BioByte: each week our writing collective highlight notable news—from the latest scientific papers to the latest funding rounds—and everything in between. All in one place.

What we read

These companies are creating food out of thin air [Claire Evans, MIT Technology Review, October 2024]

A new crop of biotech companies are utilizing autotrophic microbes to produce food. Autotrophic microbes survive on a diet of oxygen, nitrogen, carbon dioxide and water from the atmosphere. When these bacteria are grown in fermentation tanks, they can be dehydrated and used as a protein-rich powder.

There are about 25 companies around the globe using air and bacteria to produce protein. The ultimate goal of these companies is to engineer a food source far lower in emissions than conventional farming. Bacterial “crops” use much less land and water compared to factory-farmed meat (53 to 100% more efficient to produce than animal protein).

Companies such as Air Protein and Solar Foods are both using hydrogen-oxidizing bacteria that metabolize carbon dioxide. Solar Foods uses a Xanthobacter bacterium which is rich in carotenoids and useful as a replacement for flour in pasta and also as cream replacement. Solar Foods is still awaiting approval in the EU and US, but its protein Solein is already for sale in Singapore as gelato and snack bar formats.

However, besides scale, there are some challenges to overcome when it comes to the procurement of the feed. Most human-made hydrogen, a key ingredient in the bacterial feed, comes from fossil fuel, and green hydrogen comes from renewable-powered electrolysis, which is still a rare process. Carbon is rarely produced from Direct Air Capture (DAC) from the atmosphere, as it is still an energy intensive and expensive process, so gas fermentation companies mostly buy from readily available carbon dioxide. Whilst these companies could make a dent in the replacement of highly processed protein products, there are many technical and commercial milestones to achieve.

What’s next in computational drug discovery? [Leo Wossnig and Alexander Mathiasen, Oct 2024]

Leo Wossnig, CTO of LabGenius, takes a critical lens to AlphaFold3 and its impact on drug discovery. Six main issues are discussed:

1. The docking baseline was not state-of-the-art - While AF3 achieved 93.2% accuracy on PoseBusters, the baseline used wasn't truly state-of-the-art, as Inductive.bio improved the PB docking baseline from 59.7% to 79.5%.

2. Train-test set leakage - The PB benchmark had significant issues with train-test set leakage, where the same ligands appeared in both training and test sets. Studies showed that performance can increase dramatically (from 20% to 60%) when increasing train/test leakage from 0% to 80%, suggesting the need for more rigorous data splitting methods.

3. Failure modes of protein structure prediction - Despite improvements, AF3 still struggles with several types of predictions, including RNA structure, membrane proteins, and intrinsically disordered proteins. The model can make mistakes with high confidence, particularly with nucleic acids and complex assemblies, and shows varying performance across different molecular modalities.

4. Antibody problem - While AF3 shows improvements for predicting how antibodies bind to their targets, it has a major limitation: when making a single prediction attempt, it fails 60% of the time. To achieve reliable results, AF3 needs to run the same prediction 1000 different times and then select the best answer. This requires massive computing power that is expensive and time-consuming AF3 impractical for quickly screening many potential drug candidates.

5. Lack of data — PDB is done - The Protein Data Bank is reaching its limits, with new data generation being prohibitively expensive (estimated $12B to reproduce PDB). AF3 relies heavily on generated structures for training, raising concerns about potential model collapse and the limitations of training on synthetic data.

6. Structure isn’t function - Static structural predictions, even when accurate, don't capture the crucial dynamic nature of proteins and their functions. Understanding protein dynamics is essential for drug discovery, as even small structural changes can significantly impact binding and selectivity, and new approaches like 4D diffusion models are being developed to address this limitation.

“Give Cas a Chance”: Fyodor Urnov Says He Wants a CRISPR Revolution [Kevin Davies, Genetic Engineering & Biotechnology News, October 2024]

Since its monumental discovery, CRISPR-Cas9 has made headlines over the past decade; however, many proponents of its therapeutic applications fear that the widespread interest is waning. Even following the promising release of Vertex Pharmaceuticals’s Casgevy to treat sickle cell disease, enthusiasm for CRISPR-Cas9 therapies has dwindled significantly, calling to the forefront glaring challenges with getting gene-editing drugs to market. Dr. Fyodor Urnov—a close collaborator of Dr. Jennifer Doudna and himself significantly influential in the field—raises several of these in a commentary published in The CRISPR Journal on October 18th. Given the current rigorous regulations on gene-editing, CRISPR therapies must target a single mutation of a gene, necessitating that the whole approval process be undertaken each time a therapy for a new mutation is desired. This limitation is severely cost prohibitive, such that even large pharmaceutical companies have appeared markedly averse toward undertaking such a task.

Dr. Urnov argues that CRISPR is severely underutilized because of these current regulations and proposes three revolutions that will enable CRISPR therapies to gain traction. The first is a shift in clinical programs from focusing on a single mutation of a gene to focusing on multiple mutations. The entire mutation landscape is relevant; Urnov describes not doing so much like if one were to paint the skyline of San Francisco, depicting only the Salesforce Tower whilst omitting other characteristic landmarks. The second revolution Urnov postulates is a change in the IND filing process, whereby a single filing can constitute several guide RNAs. Urnov argues changing the guide RNA only alters a small fraction of the therapeutic, as much of the work is done to manage the cells before, during, and after treatment. Finally, there must be a growth in the understanding of how CRISPR therapies are made, and that greater understanding must be leveraged to create a platform that can treat a number of mutations in the same gene.

Exciting work to this end is already being done by Urnov, Doudna, and colleagues in collaboration with the IGI toward accelerating “phase-appropriate” GMP initiatives, and design for a “CRISPR Cures” Center seeking to make the therapeutic approach truly “platformizable” is already in the works with Urnov at the fore. It is imperative that the full suite of applications of CRISPR is realized, lest many potentially life-changing therapies fall to the wayside. Urnov hopes that by raising greater awareness to these issues, progress can continue to move forward.

A comprehensive proteogenomic pipeline for neoantigen discovery to advance personalized cancer immunotherapy [Huber et al., Nature Biotechnology, 2024]

Cancer immunotherapy faces significant challenges due to cancer cells' ability to evade immune system recognition through defects in antigen presentation machinery. Indeed, the accurate identification and prioritization of antigens that can effectively trigger T cell responses in heterogeneous tumors has remained a persistent challenge. While existing computational approaches typically focus solely on mutated neoantigens, they often overlook other important sources of tumor-specific antigens, such as viral antigens and tumor-associated antigens.

In this paper, the authors introduce NeoDisc, a computational pipeline that integrates multiple types of data including genomics, transcriptomics, and mass spectrometry-based immunopeptidomics to advance cancer immunotherapy. This tool accurately identifies and prioritizes tumor-specific antigens while enabling the design of personalized cancer vaccines. The pipeline is particularly valuable as it reveals critical insights into tumor heterogeneity and highlights defects in antigen presentation that could impact success rates in immunotherapy.

NeoDisc addresses these limitations through its end-to-end computational analysis of matched genomics, transcriptomics, and immunopeptidomics data from tumors. The pipeline prioritizes potentially immunogenic antigens and designs personalized cancer vaccines. Notably, the system outperforms other tools (such as pVACseq and pTuneos) in prioritizing immunogenic neoantigens, ensuring more accurate target selection for vaccines and T cell-based immunotherapies.

The pipeline is currently being used in personalized cancer vaccine trials and adoptive T cell therapies in Switzerland. While a significant advancement, it’s important to note that certain aspects of its rule-based prioritization have only been tested on a limited number of samples, and will need validation on a larger and more diverse set to establish generalizability of the technology.

Hub and Spoke Biotechs: Nimbus Therapeutics [Elliot Hershberg, Century of Bio, October 2024]

Nimbus Therapeutics is hailed as an experiment in alternative business models and structure within the biotech industry. Founded in 2011, Nimbus has adopted an innovative "hub-and-spoke" business model that allows it to sell off drug assets while retaining its core platform and team. This approach is designed to avoid the common fate of biotech startups being fully acquired by large pharmaceutical companies, enabling Nimbus to continue developing new drugs independently. Some interesting points raised by Elliot’s coverage:

After selling the ACC inhibitor to Gilead, Nimbus had to restructure and return to preclinical R&D. They funneled so much into the lead program the company was left with 22 people.

Nimbus referred to its first major deal—selling their Acetyl-CoA carboxylase (ACC) inhibitor to Gilead for $400M upfront and up to $800M in milestones—as their "Apollo mission." It marked a critical point in validating its hub-and-spoke model

Pushed the concept of "virtual drug discovery," aiming to operate with minimal in-house R&D infrastructure by leveraging computational chemistry and outsourcing to CROs. This approach allowed them to remain agile and capital-efficient, reducing R&D spend

Nimbus initially attempted to sell pre-clinical drug candidates to pharma companies but failed to gain traction until they took programs into clinical trials themselves. This insight shaped their approach to future deals.

Hub-and-spoke structure is built around an LLC, allowing for tax efficiencies by ensuring that sales of subsidiaries are only taxed once

Nimbus’s TYK2 program showed the influence pharma can have in killing/slowing a product. Nimbus entered a legal dispute when Celgene (which held an option to acquire Nimbus’s TYK2 program) was acquired by BMS. BMS had their own competing TYK2 program, giving them an incentive to hinder Nimbus’s progress.

Notable deals

Fable Therapeutics raises $53.5M to develop obesity drugs with generative protein design. The start-up is a spin-out from the Philip Kim lab at University of Toronto. Fable is focused on developing biologic therapies targeting obesity-related measures such as improving basal metabolic rate.

Merck is acquiring Modifi Bio, a Yale spinout that’s pioneering treatments for chemotherapy-resistant glioblastoma. The deal includes an upfront payment of $30 million, with potential future payments reaching $1.3 billion. Founded in 2021, Modifi Bio developed a novel suite of “DNA modifier” molecules that selectively target cancer cells while sparing healthy ones. This precision therapy is inspired by temozolomide, a chemotherapy often used for brain cancer. Modifi Bio’s co-founders, including Yale’s Ranjit Bindra, aimed to overcome the resistance many glioblastoma tumors develop. After raising $10.7 million in seed funding and facing challenges in securing further investment due to glioblastoma’s rarity, Modifi attracted Merck’s attention. Merck’s acquisition includes Modifi’s lead compound, MOD-246, and related analogues, marking a significant step toward potential new treatments for this deadly cancer.

What we liked on socials channels

Events

The State of AI in Drug Discovery 2024

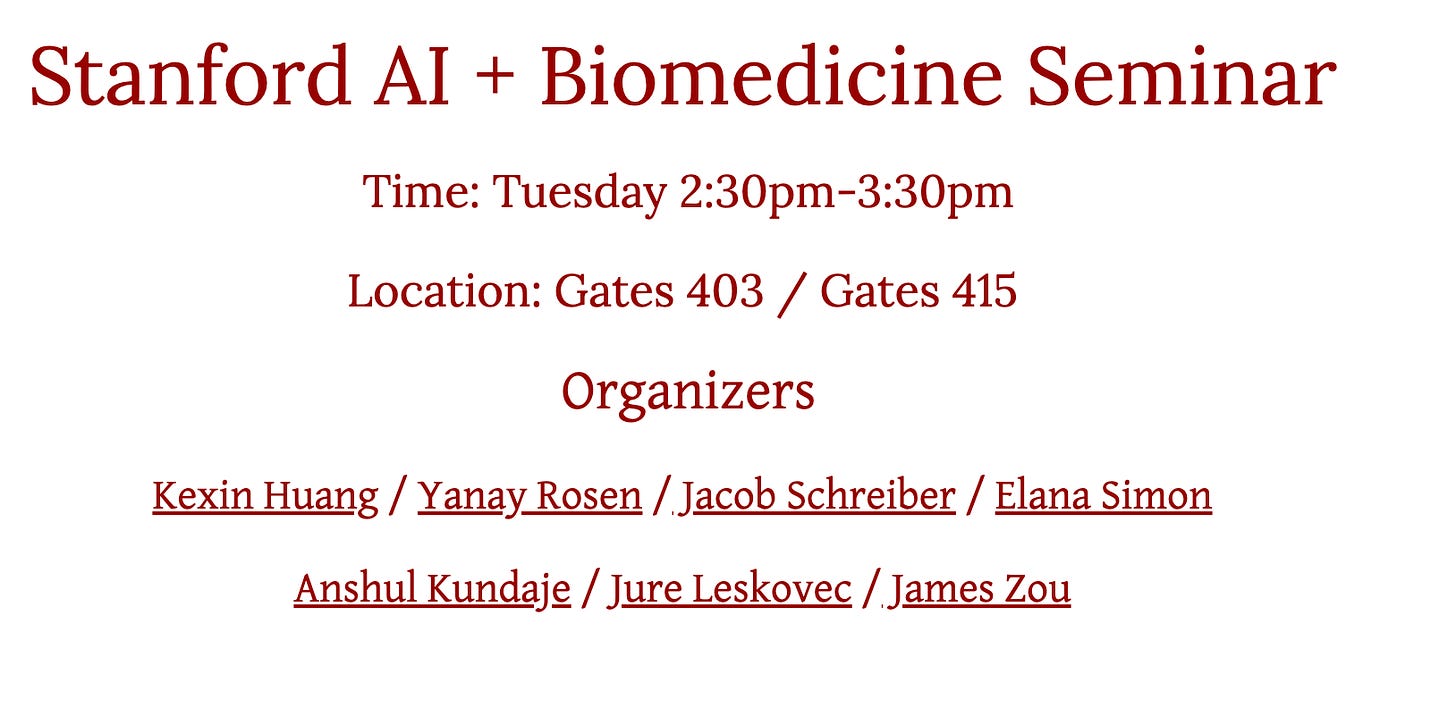

Stanford AI + Biomedicine Seminar

Field Trip

Did we miss anything? Would you like to contribute to Decoding Bio by writing a guest post? Drop us a note here or chat with us on Twitter: @ameekapadia @ketanyerneni @morgancheatham @pablolubroth @patricksmalone