BioByte 093: A big week for AI, GLP-1s program the neurovascular landscape , an AAV primer and LLCs in biotech

Welcome to Decoding Bio’s BioByte: each week our writing collective highlight notable news—from the latest scientific papers to the latest funding rounds—and everything in between. All in one place

What we read

Blogs

The Benefits And Risks Of An LLC Business Model In Biotech [Abbas Kazimi, Life Science Leader, Oct 2024]

Abbas, CBO at Nimbus Therapeutics, explains the advantages (and disadvantages) of the LLC structure for therapeutics companies.

The most compelling advantage of the LLC model, which Nimbus leverages, is the inherent flexibility in how deals and investments are structured. With a C-corp, acquiring a biotech company often means acquiring the entire entity. With the LLC structure, companies can structure deals that enable partners to acquire individual assets instead. Similarly, given development programs can act as separate subsidiaries, each with its own rights and IP, investors can invest in specific assets rather than the entire portfolio.

Another advantage of the LLC is that when individual subsidiaries are exited, capital can be returned to equity shareholders. This creates a cycle of capital returns that can be particularly attractive to investors looking to reinvest capital in the company or in external opportunities. In addition, having multiple exits that return capital to investors makes it easier to raise capital for future programs.

What are the disadvantages? For companies that rely on shared platform technology across multiple programs, the LLC can introduce complications. If a single piece of IP is used across various programmes, it can be difficult to disentangle IP and limit the ability to generate value for the program and become less attractive to potential acquirers. Additionally, an LLC can create a higher level of uncertainty for employees as programmes can be sold at any time so they may have to quickly pivot from one program to another.

US Venture Capital Opens Path to Funding for China Biotech Firms [BNN Bloomberg, October 2024]

In light of the desolate funding environment for Chinese biotech companies, there has been a push to co-create new, venture- or pharma-backed entities within the US that will develop and sell their assets in US markets, circumventing the traditional path of directly licensing assets to Western firms. These NewCos enable the parent company selling the asset to maintain a greater financial stake as the drug develops. One Chinese drugmaker, Jiangsu Hengrui Pharmaceuticals Co., discovered the financial detriment of licensing the hard way, when a company they sold an asthma asset to for $25 million, Aiolos Bio Inc., was purchased by GSK for $1.4 billion shortly after. Hengrui has since learned from this mistake, keeping a 20% stake in the recipient of their GLP-1 asset, Kailera Therapeutics, following the sale.

NewCos are not a new idea, as pharma companies like AstraZeneca and Pfizer have sold assets in this manner before. However, their expansion to Chinese companies does seem to indicate a maturation in the market and the willingness of Chinese companies to become more involved in global clinical development. They also present a formidable opportunity to evade the growing geopolitical tensions in the West—such as the noteworthy Biosecure Act in the US—that are hampering the entry of Chinese drug companies into Western markets. The formation of these Chinese held NewCos has been enabled in large part by venture firms such as Foresite Capital, Qiming Venture Partners, Third Rock Ventures, Orbimed, and Lilly Asia Ventures to name a few.

Despite the interest in NewCos from both pharma and VCs, there are still some reservations about the potential returns of these opportunities, as the actual value of the deals still hinges on the clinical data. To determine if these sorts of investments will stick around, it will take another couple years of quality clinical data and successful exits.

AAV Primer [Eric Minikel, CureFFI.org]

Adeno-associated viruses (AAVs) have emerged as a promising tool for gene therapy, offering a way to deliver therapeutic genes into cells. Discovered nearly 60 years ago, AAVs possess several advantageous features for gene delivery, including their non-pathogenic nature, ability to transduce both dividing and non-dividing cells, and long-term episomal expression without host genome integration. These traits have made AAVs an attractive option for researchers and clinicians seeking to treat genetic diseases.

The structure and genome of AAVs have been heavily studied, providing crucial insights for engineering efforts. The AAV capsid consists of 60 individual subunits, with specific regions responsible for antibody binding, DNA insertion, and cellular targeting. The wild-type AAV genome is relatively simple, encoding proteins necessary for replication, capsid formation, and assembly. The genome contains three main genes: Rep (Replication), Cap (Capsid), and aap (Assembly-Activating Protein). The Rep gene encodes four proteins essential for viral genome replication and packaging, while the Cap gene produces three viral capsid proteins (VP1, VP2, VP3) in a molar ratio of 1:1:10.

Despite their potential, AAVs face significant challenges in clinical applications. These include immune responses that can affect transduction efficiency, the potential immunogenicity of delivered genes, and factors affecting the durability of gene expression. Neutralizing antibodies and complement activation can impact AAV transduction, while the delivered gene itself may elicit immune responses. Additionally, cell division can dilute the AAV genome, and epigenetic modifications may silence the episomal DNA. Nevertheless, several AAV-based gene therapies have received FDA or EMA approval, demonstrating their viability as a treatment option for various genetic disorders.

Current research focuses on improving AAV vectors to enhance their efficiency in targeting specific organs and cell types. Engineered AAV capsids, such as those developed by the Deverman lab, aim to overcome the limitations of naturally occurring serotypes. To create recombinant AAVs (rAAVs) for gene therapy, researchers replace most of the viral genome with an expression cassette containing a promoter, the gene of interest, and a terminator. This modification allows the AAV to deliver therapeutic genes while preventing viral replication. The structure of a gene of interest (GOI) to package in an AAV typically includes various elements such as promoters, introns, and polyadenylation signals to optimize expression and stability. As the field progresses, AAV-based gene therapies hold promise for treating a wide range of genetic diseases, with ongoing efforts to optimize their delivery, expression, and safety profiles.

Papers

GLP-1 programs the neurovascular landscape [Chen et al., Cell Metabolism, Oct 2024]

A review out this week in Cell Metabolism discusses the effects of GLP-1 and GLP-1 receptor agonists on the brain, particularly focusing on their impact on the neurovascular system and potential therapeutic applications in neurological disorders. The precise role of the GLP-1/GLP-1RA in the brain has been difficult to pin down for several reasons, including the dual origin of GLP-1 both peripherally in the gut and centrally in distinct brain regions, blood-brain penetration of GLP-1, and multiple receptor locations across various cell types. The review goes in depth on many neural effects of GLP-1, but some of the highlights:

Neuroprotection - GLP-1/GLP-1RAs reduce neuroinflammation by suppressing microglial activation and promoting anti-inflammatory responses, and also protect against oxidative stress and decrease neuronal apoptosis, particularly in models of stroke and traumatic brain injury.

Neurovascular coupling and blood-brain barrier integrity: GLP-1 signaling improves cerebral blood flow and enhances BBB function and integrity by increasing the expression of tight junction proteins. This effect is particularly important in conditions like stroke, where BBB disruption can lead to secondary damage.

Cognitive function enhancement: GLP-1RAs have shown promising effects on cognitive performance, particularly in the context of metabolic disorders like type 2 diabetes and obesity. GLP-1 signaling appears to improve synaptic plasticity and promote neurogenesis, particularly in the hippocampus, a key region for memory formation. Liraglutide treatment in patients with type 2 diabetes has been shown to activate the dorsolateral prefrontal cortex and orbitofrontal cortex, areas crucial for executive function and decision-making.

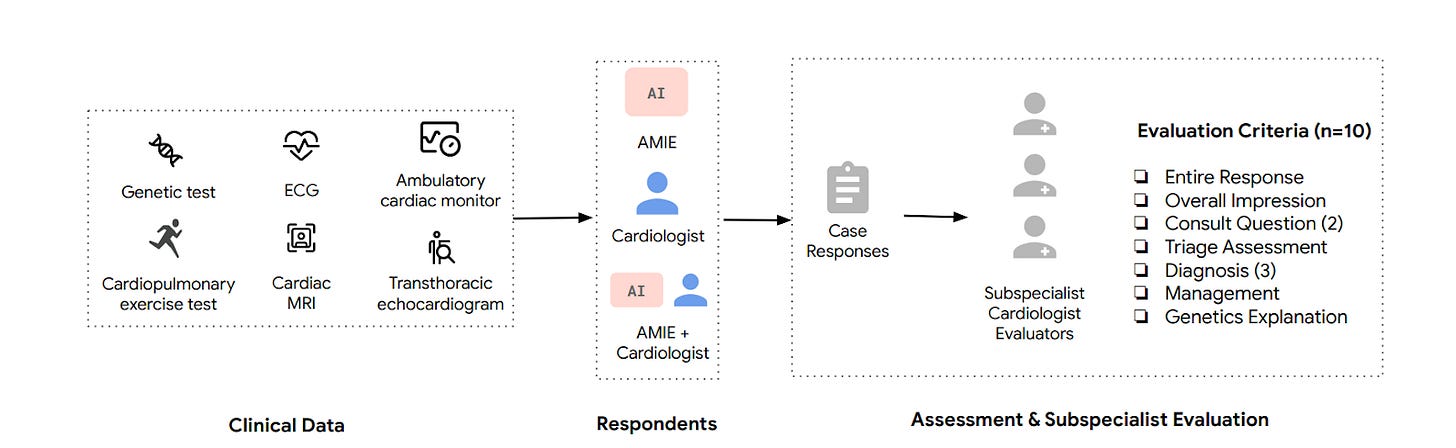

Towards Democratization of Subspeciality Medical Expertise [O’Sullivan et al., arXiv, October 2024]

Why this matters: The scarcity of subspecialist expertise, especially in complex and rare medical conditions, poses a significant challenge in healthcare delivery, often leading to delayed diagnoses and preventable deaths. AMIE’s potential to augment generalist care by providing subspecialist-level insights could bridge critical gaps in healthcare access, enabling more timely and accurate diagnoses. This could be particularly transformative in regions with limited access to subspecialist care, improving patient outcomes and reducing healthcare disparities globally. However, further validation is required before deploying such systems in clinical practice.

The study presented in the uploaded document focuses on the use of the Articulate Medical Intelligence Explorer (AMIE), a large language model (LLM)-based system, to support clinical decision-making in cardiology, particularly in diagnosing complex and rare cardiovascular conditions. The researchers evaluated the model by comparing its performance with that of general cardiologists using a real-world dataset of 204 complex cardiology cases. The study demonstrated that AMIE outperformed or was equivalent to general cardiologists in 5 out of 10 domains assessed, particularly in genetic explanations and detailed management plans. The model was also found to complement cardiologists by providing thorough, sensitive assessments, while general cardiologists offered more concise and focused recommendations.

Notable deals

Eli Lilly, Insitro ink a new kind of AI drug development deal.Eli Lilly and Insitro have entered into a unique AI-driven drug development partnership focusing on metabolic diseases. Unlike typical agreements where large pharmaceutical companies lead the process, Insitro is flipping the script and will take responsibility for developing and commercializing the drugs it identifies, with Lilly receiving royalties and milestone payments. This is notable as Insitro has never brought drugs to market but is confident in its machine learning platform's ability to drive the process. There are no licensing fees for Lilly’s GalNAc technology, but LIlly will take royalties.

The partnership covers three agreements, including the development of an antibody for an unspecified metabolic disease, and the use of Lilly’s N-acetylgalactosamine (GalNAc) delivery technology for two small interfering RNA (siRNA) therapeutics targeting the liver. Insitro retains global rights to these programs while collaborating with Lilly in the early stages to leverage its expertise in biologics.

Basecamp research raises $60M Series B and signs multi-year partnership with David Liu Lab. The team are focusing on a critical problem in ML for biology: data. The company are collecting data samples from extreme environments across the planet to augment the current datasets for biology we have. Some potential applications include that with Liu, where Basecamp’s data will help shed light on novel gene-editing technologies.

Enara Bio raises a $32.5M Series B to advance its lead program through candidate-seeking studies. The Oxford-based biotech is developing TCR-therapies targeting ‘dark’ antigens on tumor cells.

City Therapeutics launches with $135M, spearheaded by John Maraganore, founder of RNAi pioneer Alnylam. This new venture focuses on advancing RNAi technology by targeting previously hard-to-reach organs and tissues using small cleavage-inducing tiny RNAs (cityRNAs). Starting a new company allows Maraganore to build a focused platform unburdened by the priorities and infrastructure of a larger, established company like Alnylam. It offers the flexibility to innovate rapidly, pursue cutting-edge RNAi applications, and attract capital specifically for this next-generation technology without diluting focus or resources from Alnylam’s existing programs.

Integrated Biosciences raises $17M to advance its AI-driven search for potential drugs targeting age-related diseases. The team have developed a synthetic biology system that delivers LED light to standard cell plates, simulating stress conditions in the cells. The team then use deep learning to screen molecules and identify those capable of reversing the stressed-out phenotype.

In case you missed it…

These Are the Winners of the 2024 Nobel Prizes [Popli, Time, October 2024], Google DeepMind scientists win Nobel chemistry prize [Devlin, The Guardian, October 2024]

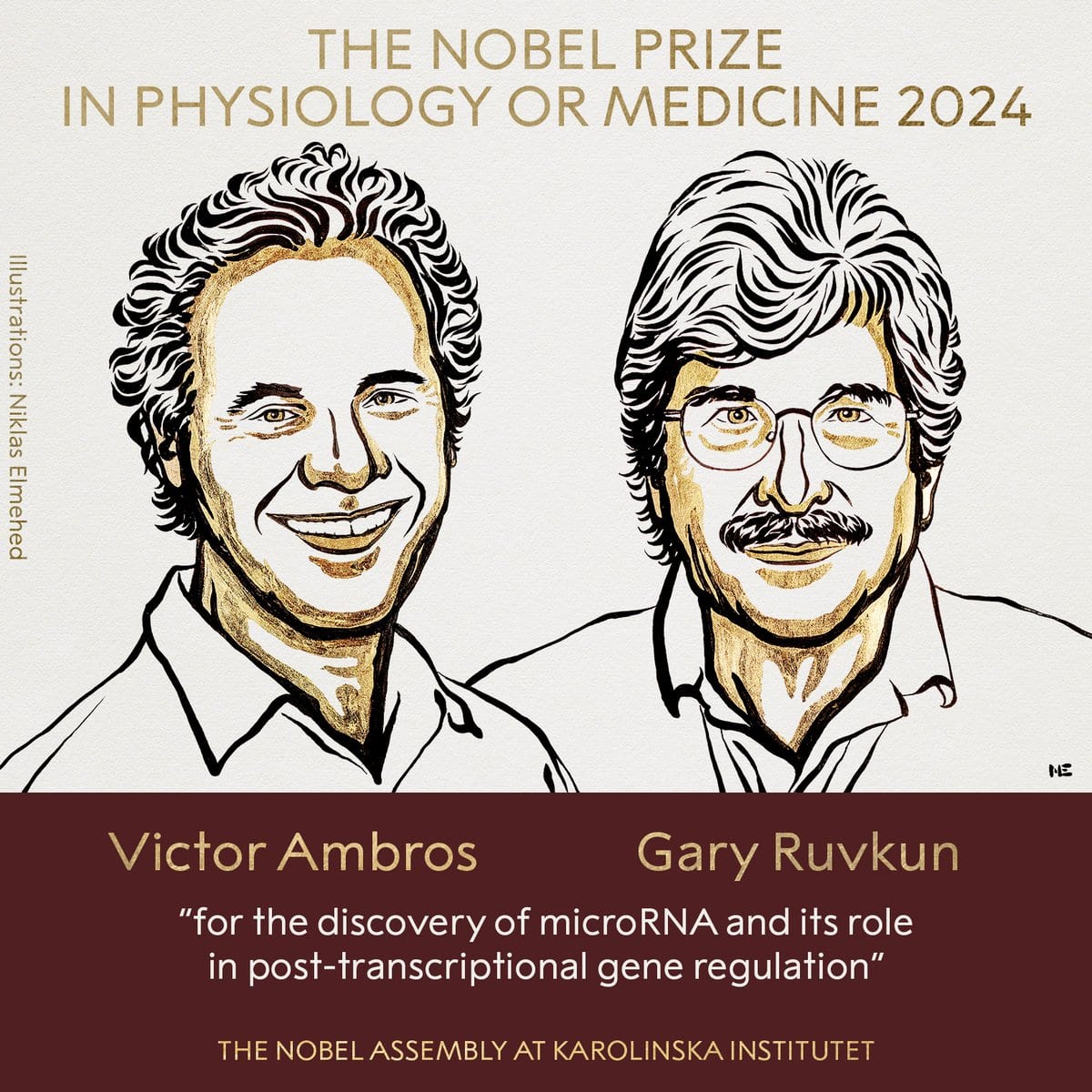

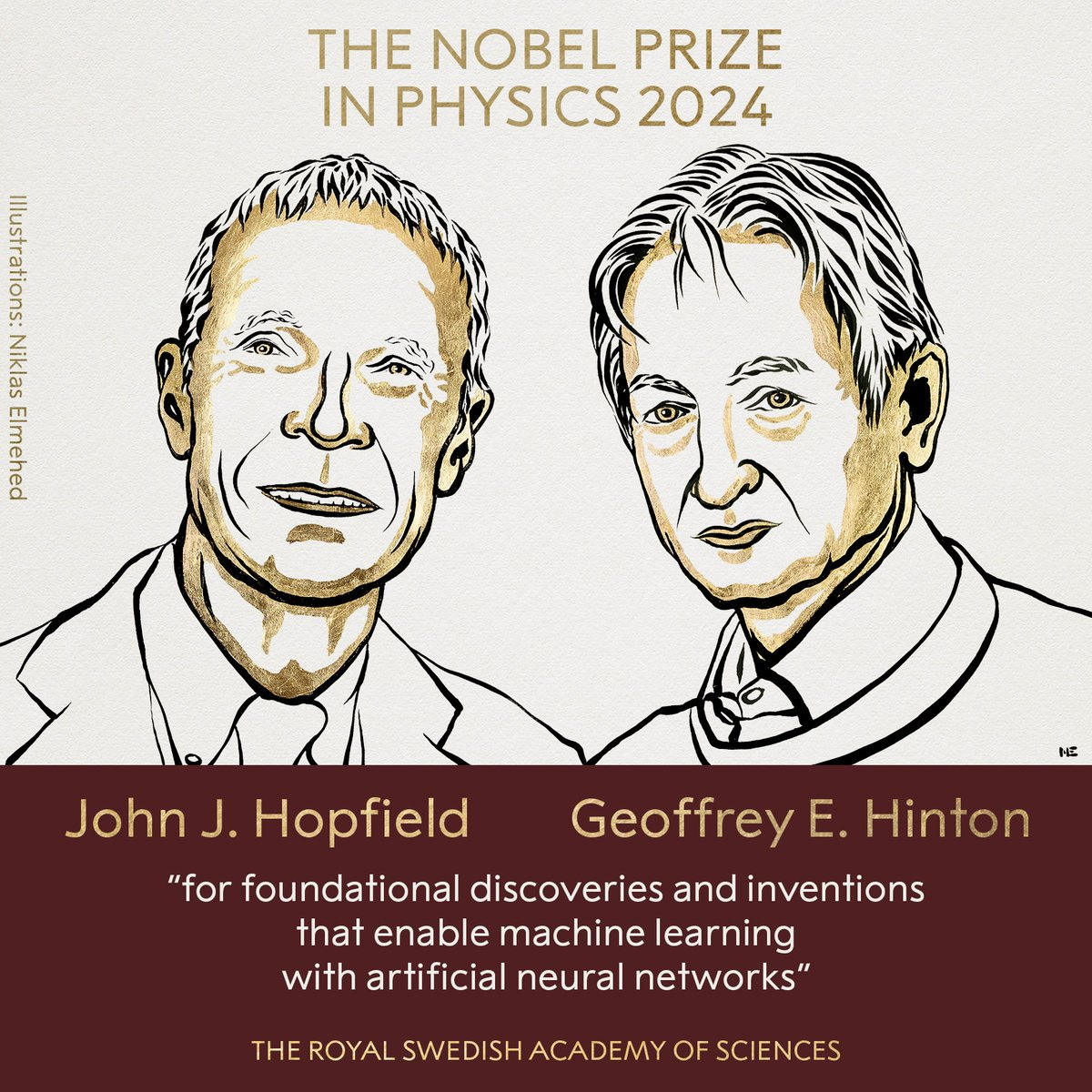

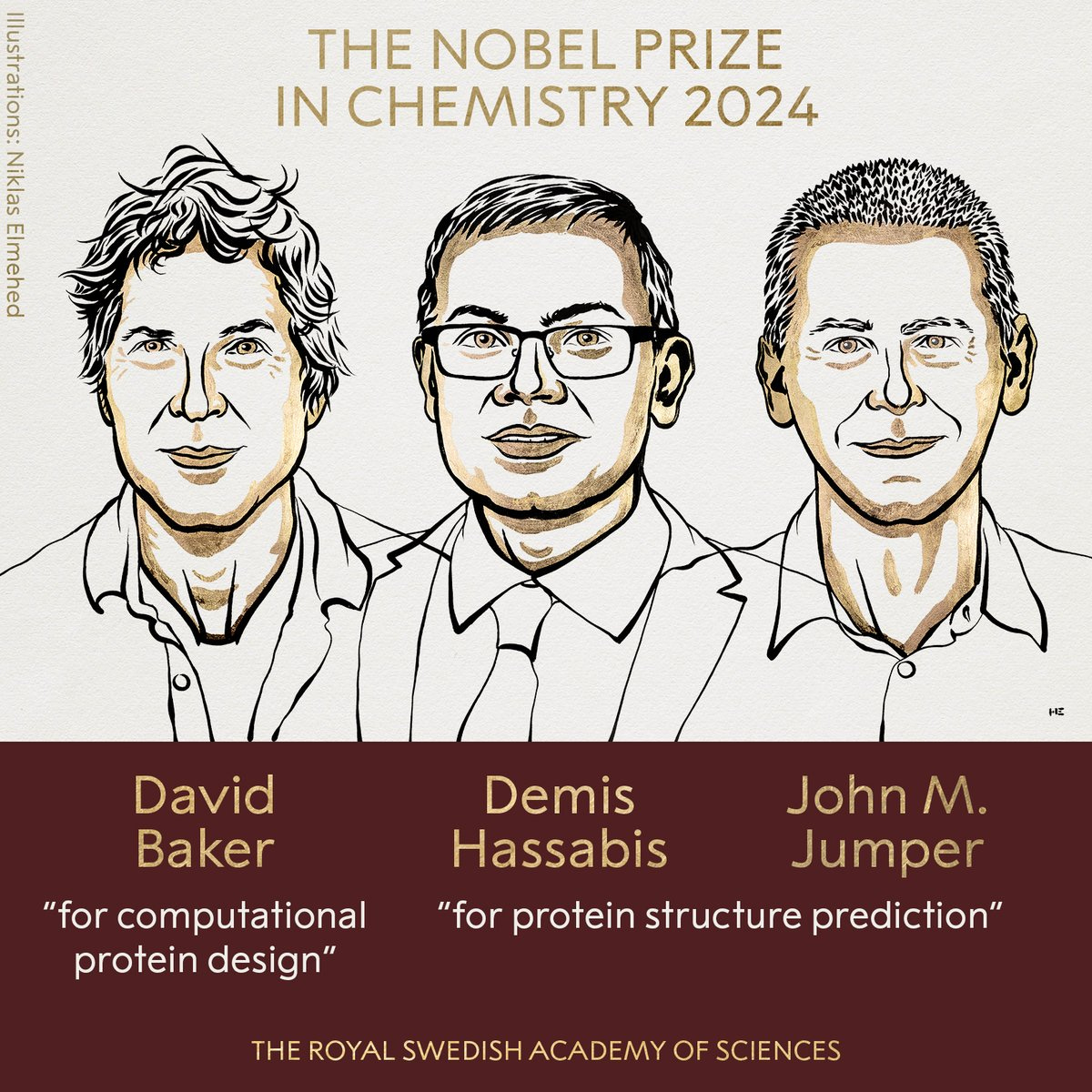

The 2024 Nobel Prizes began with groundbreaking achievements in physiology/medicine and physics, highlighting innovative research with profound implications for human health and artificial intelligence.

Physiology or Medicine: Victor Ambros and Gary Ruvkun were awarded for their discovery of microRNAs, small molecules crucial for gene regulation. Their research, originating from studies on roundworms, unveiled how microRNAs regulate protein production, influencing diseases like cancer and heart disease.

Physics: John J. Hopfield and Geoffrey E. Hinton were recognized for applying statistical physics to the development of artificial neural networks, revolutionizing machine learning. Their work advances fields ranging from astrophysics to daily technologies like facial recognition.

Chemistry: Demis Hassabis, John Jumper (Google DeepMind), and David Baker (University of Washington) were honored for advancements in protein structure prediction and design. Hassabis and Jumper’s development of AlphaFold 2, an AI model that predicts protein structures from their sequences, has far-reaching applications in health and materials science. Baker’s work in designing new proteins opens possibilities for novel vaccines and nanomaterials.

What we liked on socials channels

Events

Founder Led Biotech On Tour - Pillar VC

Field Trip

Did we miss anything? Would you like to contribute to Decoding Bio by writing a guest post? Drop us a note here or chat with us on Twitter: @ameekapadia @ketanyerneni @morgancheatham @pablolubroth @patricksmalone